The key support level highlighted in the previous report at 1.1260 successfully halted the recent bearish pressure, triggering a bullish rebound in line with the expected positive scenario. The EUR/USD pair is currently trading around 1.1335.

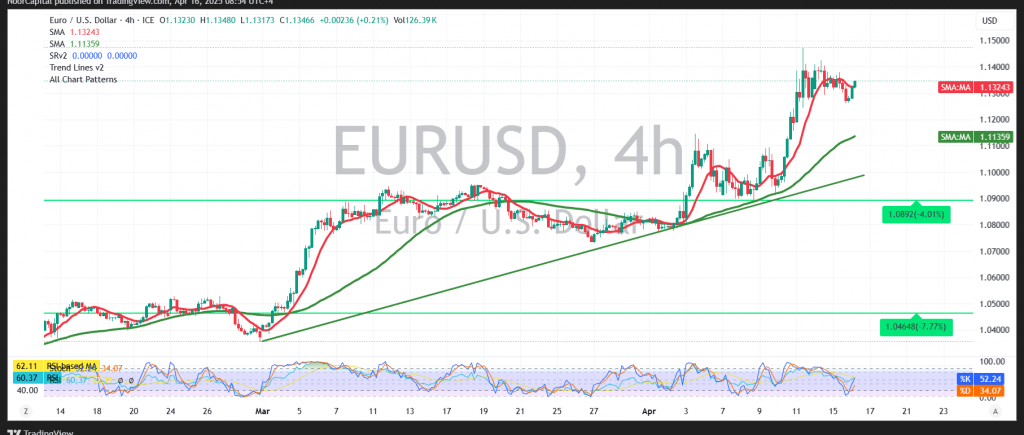

From a technical standpoint, the euro appears to have established a solid base near 1.1260. A closer look at the 4-hour chart reveals encouraging signs from the Relative Strength Index (RSI), which has cleared oversold conditions and is now signaling positive momentum.

As long as intraday trading remains stable above the psychological support at 1.1300—and more broadly above 1.1270—the bullish outlook remains intact. In this scenario, the pair is likely to target 1.1390 initially. A confirmed break above that level would strengthen bullish momentum and increase the likelihood of a move toward the 1.1445 resistance zone.

However, a sustained move back below 1.1270 would put pressure on the pair, with the next potential downside target seen at 1.1210.

Key Event Risk Today:

High-impact economic data releases are scheduled, including:

- United States: Retail Sales figures and a speech by a Federal Reserve Governor

- Canada: Bank of Canada (BoC) interest rate decision, monetary policy report, and press conference from the BoC Governor

These events could drive significant volatility in the markets.

Risk Disclaimer: Market risks remain elevated amid ongoing global trade tensions and central bank policy shifts. All scenarios remain possible—caution is advised.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations