The euro continues its gradual ascent against the US dollar, maintaining consistent technical patterns for the third consecutive session.

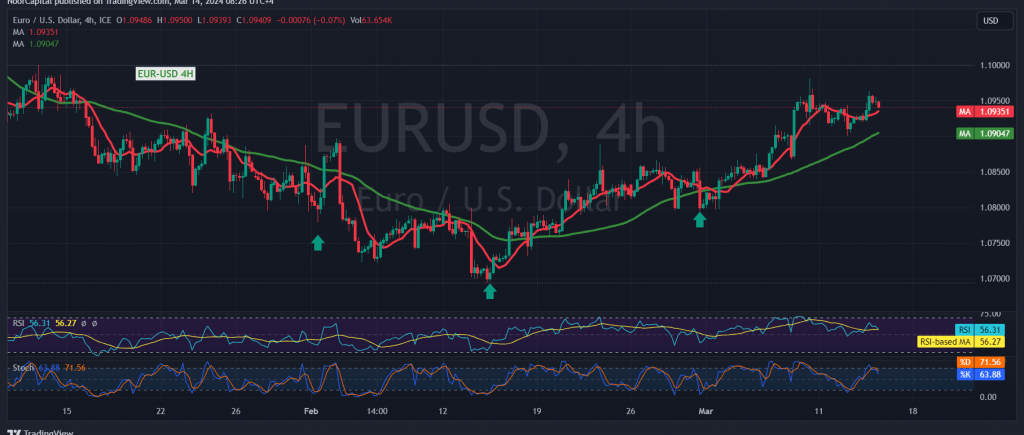

Analyzing the 240-minute timeframe chart, the simple moving averages persist in guiding the price from below, reinforcing the bullish technical structure evident on the chart.

With daily trading sustained above the robust support level at 1.0860, the bullish scenario remains robust and effective. The initial target stands at 1.0960, with a breach serving as a catalyst for increased momentum towards further gains, potentially reaching 1.1030. Subsequently, 1.1070 represents a significant milestone along this upward trajectory.

However, a breach below 1.0860 could revive bearish sentiment, necessitating vigilance towards the 1.0810 level to gauge subsequent price direction.

Investors should exercise caution, particularly in light of anticipated high-impact economic data releases from the US economy today. Key indicators include core monthly and annual producer prices, monthly producer prices, and retail sales. These releases may prompt significant price fluctuations and warrant careful monitoring.

By providing a detailed technical analysis and highlighting impending economic events, this report aims to guide investors in navigating potential market movements and associated risks.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations