Positive trades dominated the euro’s movements against the US dollar during yesterday’s trading, trying to build on the 0.9740 support floor.

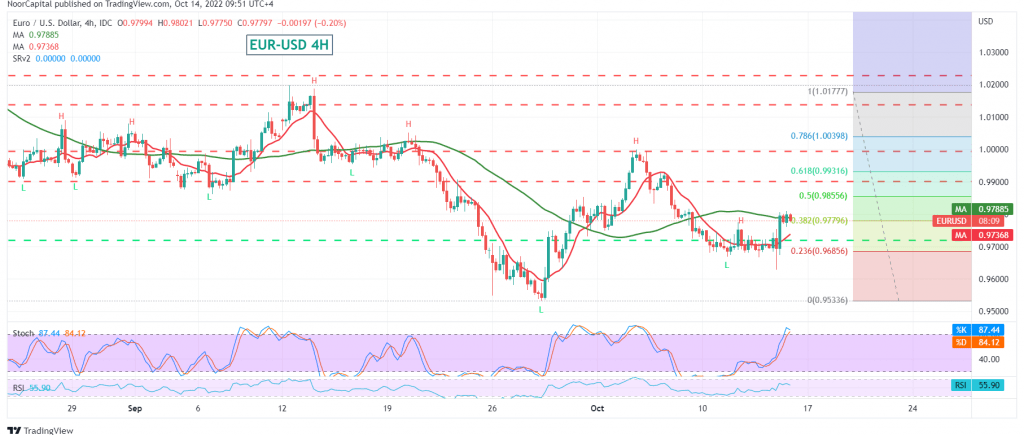

Technically, and carefully looking at the 240-minute chart, we find the pair is moving above the 50-day simple moving average, accompanied by the beginning of positive signs appearing on the 14-day momentum indicator on the 60-minute time frame.

Therefore, the possibility of a bullish bias in the coming hours is still likely, targeting 0.9810, a first target, considering that a breaching up and rising above 0.9810 might enable the euro to rally to visit 0.9860/0.9850 50.0% Fibonacci correction next price station.

Activating the suggested scenario depends on the stability of the daily trading above 0.9740 level. Breaking it puts the pair under negative pressure again, targeting a retest of 0.9700, and it may extend towards 0.9670 before repeating the attempts to rise again.

Note: “US Retail Sales” is due today and may witness price fluctuation.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9670 | R1: 0.9850 |

| S2: 0.9565 | R2: 0.9920 |

| S3: 0.9490 | R3: 1.0030 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations