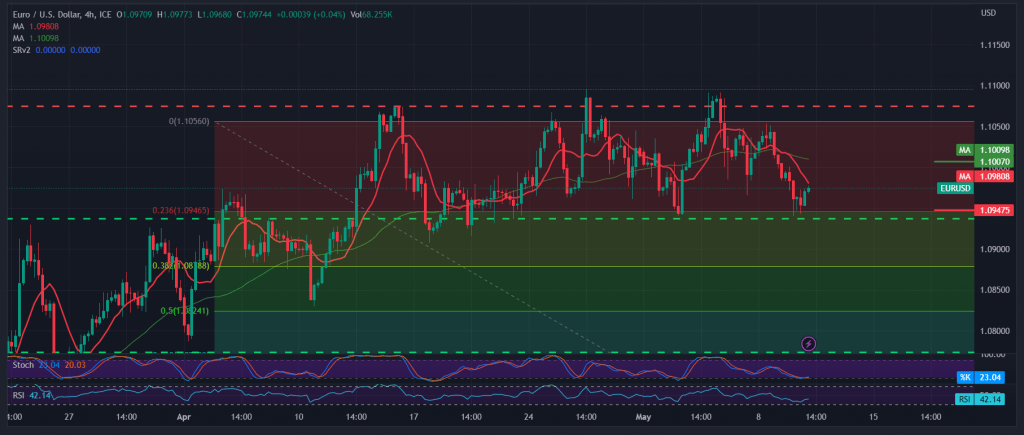

The EURUSD pair declined significantly during the previous trading session’s dealings within the scenario of retesting the support published in the last analysis, touching the required target at 1.0945 and recording its lowest level at 1.0945.

Technically, today, we find the EUR/USD pair trying to take advantage of the strong support floor represented by the target 1.0940 at Fibonacci correction 23.60%, as shown on the 240-minute chart, and we find that the stochastic indicator started to provide positive crossover signals that might lead the price to achieve some incline.

Therefore, with trading remaining stable above 1.0940, the bullish bias is most likely during the day, targeting 1.1000 as the first target, knowing that the pair’s consolidation above the mentioned level may enhance the achievement of some additional gains towards 1.1040 and 1.1070, respectively.

From below, confirmation of a breach of 1.0940 can thwart the suggested scenario, and the pair begins to complete the bearish slope started yesterday, with targets starting at 1.0900.

Note: Today, we are awaiting high-impact economic data issued by the US economy, “US inflation data, consumer price index,” and we may witness high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations