Mixed trades dominated the euro’s movements against the US dollar during the previous trading session, as the euro’s movements witnessed a negative sideways tendency confined from the bottom above 1.2075 and from the top below 1.2175.

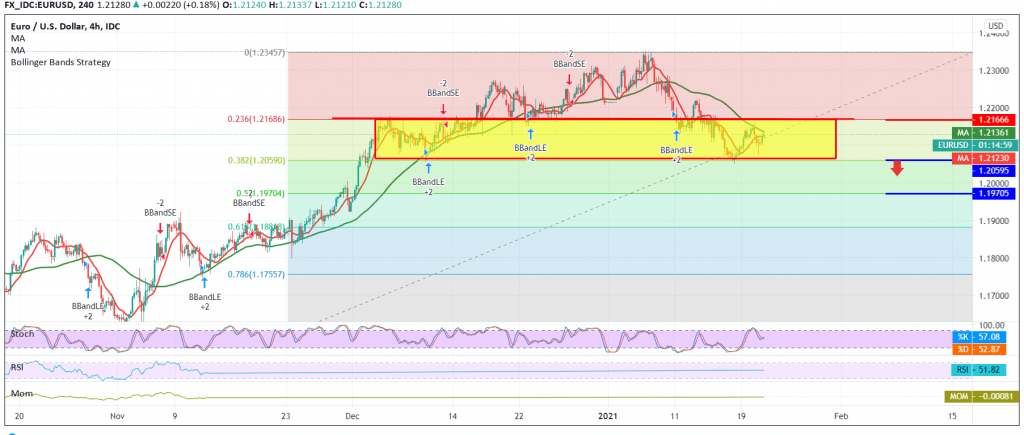

On the technical side today, and by looking at the 4-hour chart, we find the stochastic indicator moving negatively accompanied by the price stability below 1.2175 resistance level Fibonacci correction 23.60%, supporting the continuation of the negativity, and by moving to the 60-minute time frame, we find the RSI indicator is showing positive signs supported by the intraday stability above 1.2100 level.

With the technical signals contradictory, we will stand on the fence for the moment until the daily trend becomes clearer waiting for one of the following scenarios: To get a bullish daily trend, we need to confirm the breach of 1.2175, which is a catalyst that increases the chances of an upside to visit 1.2200 and then 1.2250.

The activation of short positions depends on trading stability below 1.2175. We also need to witness a break of 1.2065, a correction of 38.20%, and from here the euro will resume the bearish correction with an initial target of 1.2045 and extend to 1.2000, bearing in mind that the confirmation of a break of 1.2000 forces the pair to enter a strong bearish wave with first target around 1.1975 50.0% retracement.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations