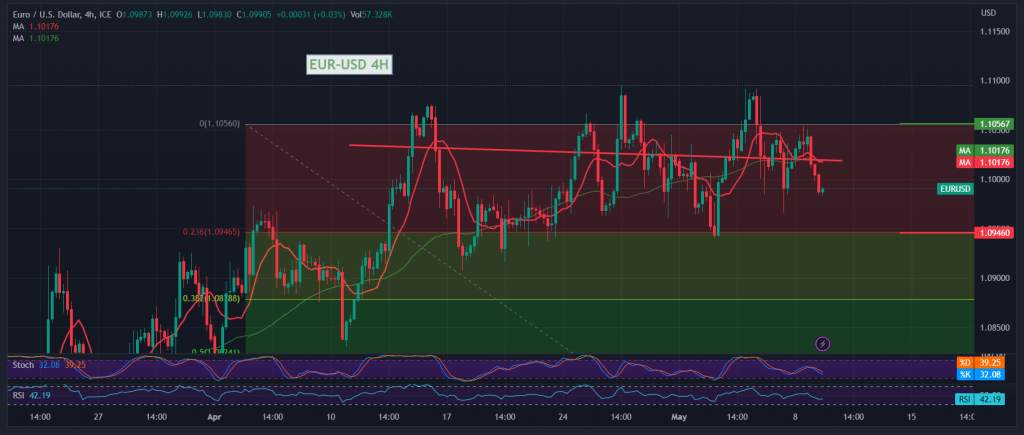

Quiet trading tended to be negative, dominating the movements of the euro-dollar pair during and throughout the trading of this week, after it found selling pressure near the resistance level of 1.1070, to start today’s session on a bearish slope.

From the point of view of technical analysis today, and with a closer look at the 240-minute chart, we find that the pair started pressing on the support level of 1.0990, affected by the return of the 50-day simple moving average, by the negative pressure on the price from above, in addition to the limitation of the bullish momentum.

We may witness a bearish tendency in the coming hours, by closing an hourly candlestick below 1.0990, targeting a retest of 1.0945 represented by 23.60% Fibonacci correction, as shown on the chart, of the losses, about 1.0905.

On the other hand, if the pair succeeds in consolidating and stabilizing above 1.0909, and returning to consolidate above the pivotal resistance 1.1070, from here, the Euro-dollar pair will restore the bullish track, with targets starting at 1.1100 and extending towards 1.1150.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations