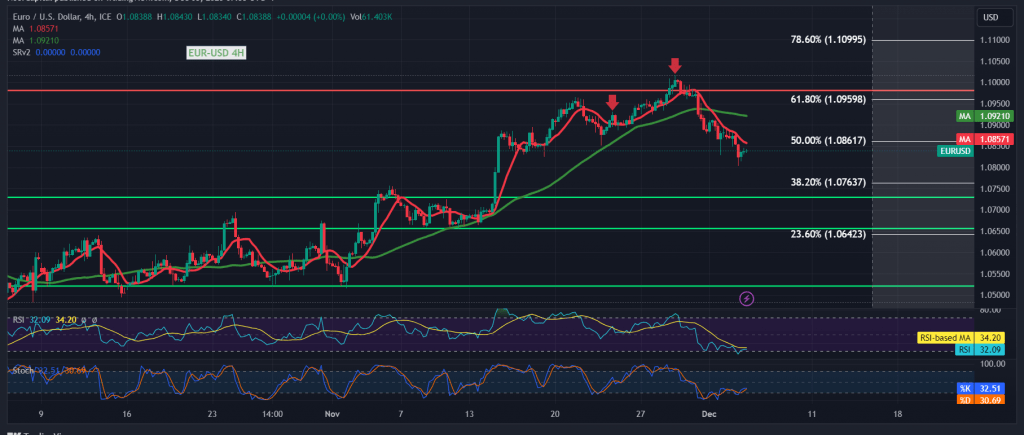

Negative trends dominated the initial trading sessions of the week for the Euro/Dollar pair, exerting downward pressure on the 1.0860 support level and reaching a low of around 1.0840 in the early stages of the current session.

From a technical analysis perspective today, a closer look at the 240-minute time frame chart reveals increasing pressure from the simple moving averages on the price from above, indicating the potential for a decline. Additionally, the Relative Strength Index is signaling negativity on shorter time intervals.

The inclination is toward a negative outlook, but with caution, especially as long as the pair remains below the resistance levels of 1.0885 and, crucially, 1.0900. The target is set at 1.0800 initially, with the understanding that a breach below 1.0800 could lead to further losses, targeting 1.0760 as the subsequent significant level.

A positive shift could be considered if there is an upward cross and sustained trading above 1.0900, closing the candlestick for at least an hour. In such a scenario, the likelihood of a decline diminishes, and a positive trading session may unfold with the goal of retesting the 1.0960 Fibonacci retracement at 61.80%.

Caution: The day includes the release of high-impact economic data from the American economy, including the ISM Services Purchasing Managers’ Index, job vacancies, and the labor turnover rate. Expect potential high volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations