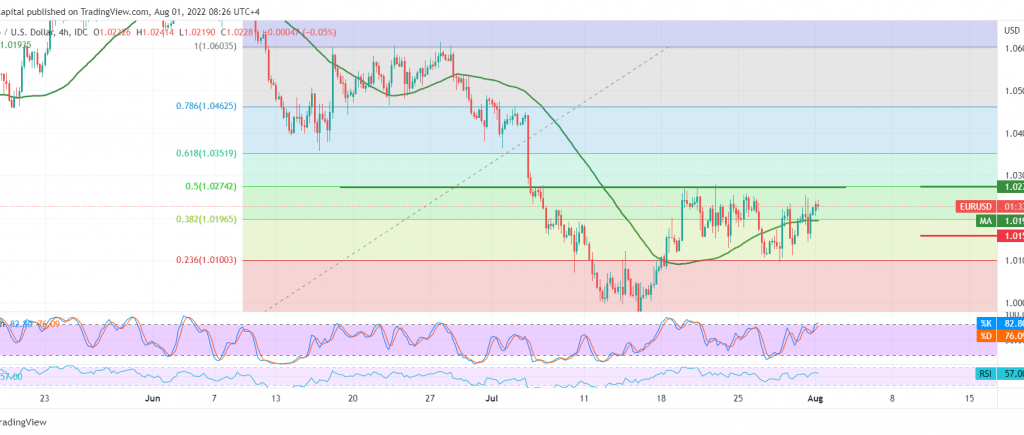

The euro showed upward movements against the US dollar, which continued its descending correction to its lowest level in 3 weeks to record the highest level last Friday at 1.0254.

Today’s technical vision indicates the possibility of continuing the bullish bias due to the positive motive coming from the 50-day simple moving average, which carries the price from below, in addition to the RSI’s attempts to stabilize above the mid-line 50 on short time intervals.

With daily trading remaining above 1.0160, the bullish bias may be the most likely during the session, targeting 1.0275, a 500% correction as shown on the chart.

We must pay close attention and monitor the pair’s price behaviour around 1.0160 because breaking it may stop the suggested bullish bias and return the euro to the downside direction, with targets starting at 1.0100 before determining the next price target.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0160 | R1: 1.0270 |

| S2: 1.0100 | R2: 1.0320 |

| S3: 1.0055 | R3: 1.0380 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations