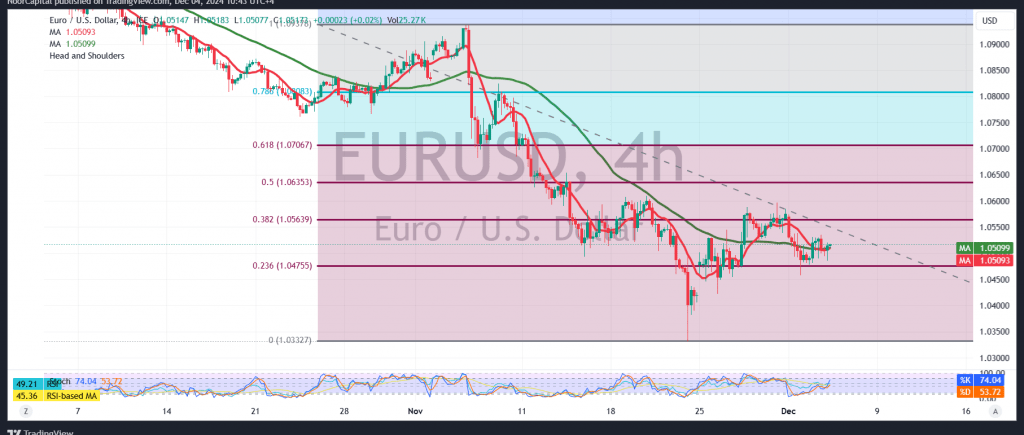

Narrow sideways trading dominates the movements of the euro against the US dollar, confined from below above 1.0480 and from above without resistance 1.0510.

On the technical side today, and with a closer look at the 4-hour chart, we find that the simple moving averages still support the possibility of a decline, motivated by the loss of the upward momentum of the Stochastic indicator and starting to send negative signals.

From here, we expect the continuation of the downward trend, provided that it sneaks below 1.0480, which facilitates the task required to visit 1.0450, the first target, and then 1.0400, the official station.

We remind you that exceeding the upward resistance level of 1.0540 and most importantly 1.0560, the 38.20% correction, may push the pair in an attempt to recover with the aim of retesting 1.0635, the 50.0% Fibonacci correction.

Warning: Today we are waiting for high impact economic data from the US economy “non-farm private sector jobs change, ISM services PMI, Federal Reserve Chairman Jerome Powell’s speech” and we may witness high volatility in prices at the time of the news release.

Warning: The level of risk is high amid the ongoing geopolitical tensions and all scenarios may be possible.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations