In the preceding trading session, the EUR/USD pair exhibited a predominantly narrow-range side trading pattern, maintaining stability beneath the pivotal support level of 1.0760 and above the resistance threshold at 1.0820.

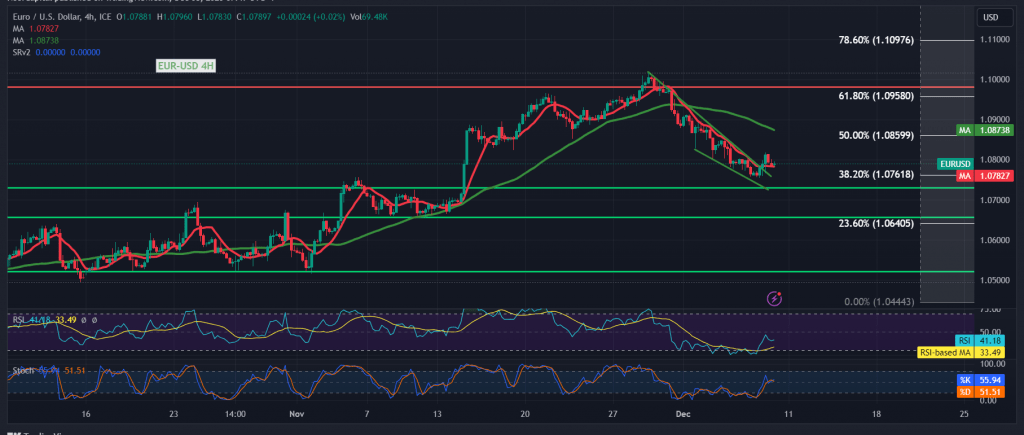

A closer examination of the 240-minute timeframe chart reveals that the 50-day simple moving average continues to exert downward pressure on the price, indicating a prevailing bearish sentiment. However, a noteworthy counterpoint emerges as the price remains steadfast above the robust support level of 1.0760, signified by the 38.20% Fibonacci retracement. Positive signals from the 14-day momentum indicator complement this support.

Amidst the current consolidation within the specified trading boundaries and conflicting technical signals, a prudent approach involves vigilant observation of price dynamics, anticipating one of the following scenarios:

Should the downward trajectory persist, contingent upon breaching 1.0760, the initial target becomes 1.0720, followed by 1.0685. Conversely, a bullish movement consolidating the price above 1.0820 holds the potential to amplify the pair’s gains, aiming for a retest of 1.0860, representing the initial target aligned with the 50.0% Fibonacci retracement.

It is crucial to exercise caution today, given the impending release of high-impact economic data from the American economy—specifically, non-farm payroll jobs data, average wages, and unemployment rates. Expect heightened price volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations