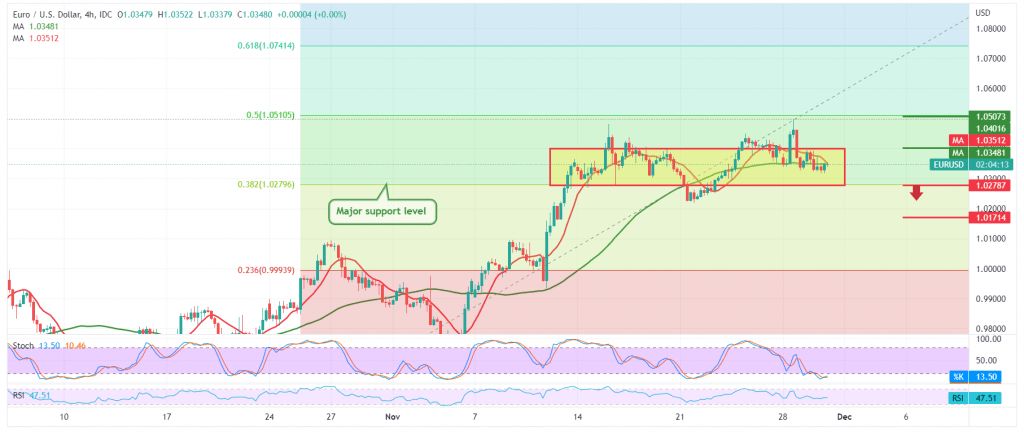

Limited sideways trading dominates EUR/USD, confined from the bottom above 1.0320, and from the top below 1.0400, for the second consecutive session.

On the technical side today, we notice a contradiction between the technical signals, and we find the 50-day simple moving average that started pressuring the price from above. But, on the other hand, positive features are still visible on the stochastic.

From here, with the conflicting technical signals and the confinement of trading between the levels above, we prefer to monitor the price behavior to be facing one of the following scenarios:

For a bearish trend, we must witness a clear and strong break of the demand area 1.0280, Fibonacci retracement of 38.20%, targeting 1.0230 & 1.0170 awaited targets.

The bullish trend depends on the ability of the Eurodollar pair to cross upwards and consolidate above the resistance of the psychological barrier 1.0400, which is a motivating factor that leads the pair to restore the bullish path, with targets starting at 1.0465 and extending towards 1.0520.

Note: Today we await high-impact data from the US economy, in addition to the speech of “Jerome Powell” Chairman of the Federal Reserve, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0280 | R1: 1.0400 |

| S2: 1.0230 | R2: 1.0465 |

| S3: 1.0130 | R3: 1.0520 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations