Narrow sideways movements dominated the performance of the EUR/USD pair. As a reminder, we preferred to monitor the pair’s price behavior during the previous report due to conflicting technical signals, explaining that we are waiting for the pending orders to be activated until we get a stronger trend.

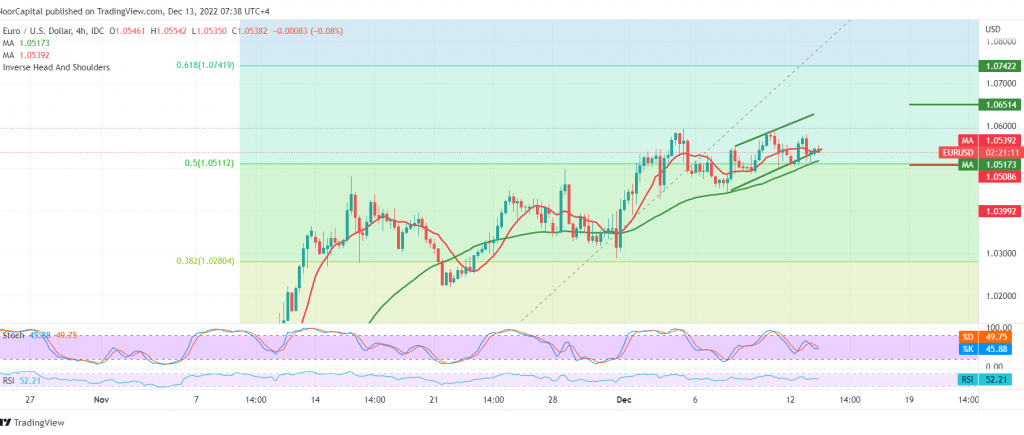

Technically, we find the movements settled within a narrow range from the bottom above 1.0500 and from the top below 1.0570. by looking at the 4-hour chart, we find the euro stable above the support level of 1.0510 represented by the 50.0% Fibonacci correction, we note that the pair continued to receive a positive incentive from the Simple Moving Average 50. Today, those technical factors support the rise. On the other hand, we find the stochastic indicator moving negatively, in addition to the stability of trading below the resistance level of 1.0570.

For the second session in a row, we prefer to monitor the price behavior of the pair to get a clearer directional signal, to be in front of one of the following scenarios:

Consolidation below 1.0500, and more importantly 1.0480, will lead the pair to a downward path, with targets starting at 1.0450 and extending to 1.0400.

Consolidation above 1.0580 is a catalyst that enhances the chances of resuming the rise towards 10620 and 1.0650, respectively, and the gains may extend later to visit 1.0740, Fibonacci correction of 61.80%.

Today we are awaiting high-impact economic data, and we may witness fluctuations at the time of news release:-

- The consumer price index from the United States of America is one of the most important measures of inflation and has an impact on the interest rate decision.

– Change in unemployment benefits from the UK, Bank of England Governor’s Speech.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0480 | R1: 1.0570 |

| S2: 1.0450 | R2: 1.0620 |

| S3: 1.0400 | R3: 1.0655 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations