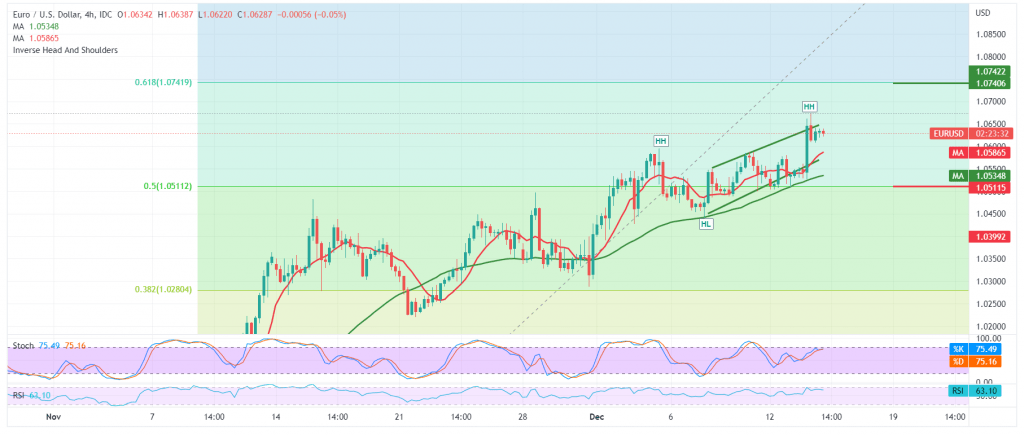

A noticeable surge for the euro-dollar pair yesterday, for the euro to take advantage of the weakness of the US dollar after the inflation data, and as a reminder, we preferred to monitor the price behavior of the pair waiting for trading orders to be activated, explaining that activating purchase orders requires a breach of 1.0580 in order to facilitate the task of visiting 1.0650, for the euro to record its highest level against the US at 1.0673 .

Technically, we find the simple moving average holding the price from below and supporting the daily bullish price curve, and this comes in conjunction with the pair’s need for intraday stability above the resistance level of 1.0570, and in general stability above the main support floor for the current trading levels 1.0510, represented by Fibonacci correction 50.0%.

Therefore, the resumption of the rise is more likely during the day, continuing towards the official target of the current rising wave 1.0740, the correction of 61.80%. It should be well noted that confirming the breach of 1.0740 increases and accelerates the strength of the bullish trend, opening the door to 1.0840, unless we witness any trading below 1.0510.

The decline below 1.0510 is able to completely thwart the bullish scenario and lead the Euro to enter a corrective decline, with initial targets around 1.0465 & 1.0410.

Note: Today we are awaiting high-impact economic data from the United States of America, and we may witness high volatility:

Fed interest rates

Fed statement

Fed press conference

Economic forecasts

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0545 | R1: 1.0690 |

| S2: 1.0465 | R2: 1.0755 |

| S3: 1.0390 | R3: 1.0840 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations