The EUR/USD pair experienced a significant drop at the end of last week, opening this week with a downward price gap due to a strengthening U.S. dollar. The pair is currently trading around 1.0757, its lowest level in early trading today.

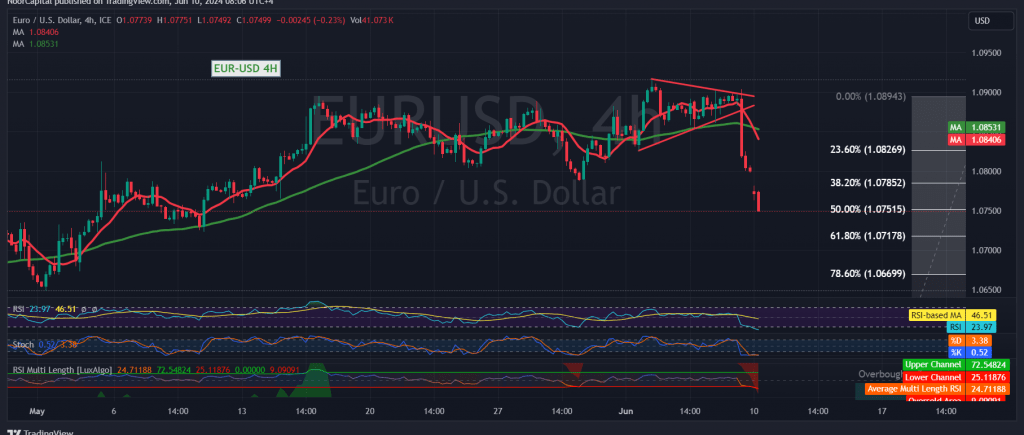

Technical analysis on the 4-hour chart reveals a bearish outlook. The simple moving averages have crossed above the price, indicating downward pressure, and the pair has fallen below the 1.0785 support level, which also coincides with the 38.20% Fibonacci retracement level.

These factors suggest a continuation of the downward trend. A decisive break below the crucial 1.0750 support level, representing the 50.0% correction, could trigger further declines. The initial target for this bearish move is 1.0710, followed by the next significant support level at 1.0660.

However, a rebound and consolidation above 1.0785, and more importantly 1.0830, could invalidate the bearish scenario and lead to a temporary recovery in the euro. In this case, the pair could potentially retest the 1.0950 level.

Investors should remain cautious as the U.S. economy is set to release high-impact economic data, specifically the “Change in Non-Agricultural Private Sector Jobs” report. This data could introduce significant volatility into the market and potentially influence the EUR/USD pair’s direction.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations