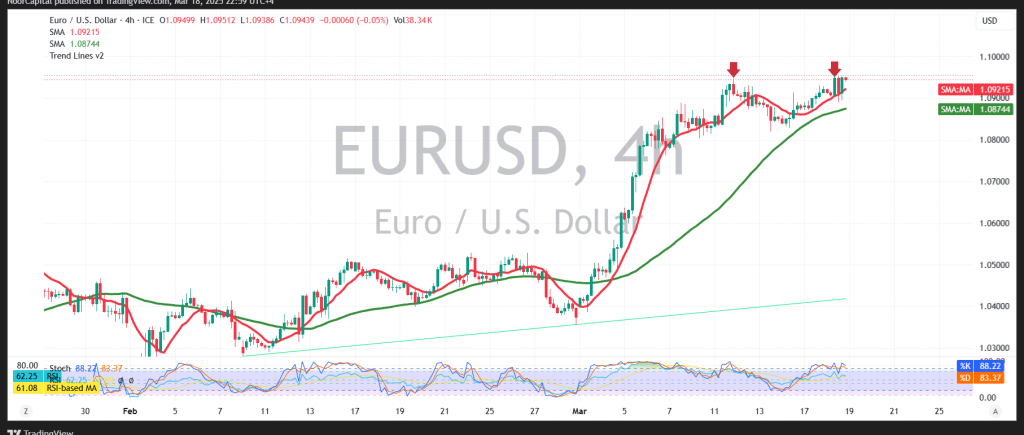

The euro continues to exhibit positive stability against the US dollar, aligning with the expected outlook after reaching the official target level of 1.0945 in the latest technical report, recording a high of 1.0954.

From a technical perspective, the 4-hour chart indicates that the euro is encountering key resistance between 1.0955 and 1.0960. The simple moving averages remain supportive of the upward trend, while the stochastic indicator signals overbought conditions, which could introduce some negative pressure.

As long as intraday trading remains below 1.0960, there is a possibility of temporary downside movements, with the pair targeting a retest of 1.0890. A break below this level may extend the corrective decline toward 1.0840. Conversely, a sustained move above 1.0960, and more importantly, 1.0975, could invalidate this scenario, allowing the pair to resume its upward trajectory toward 1.1010 and 1.1060.

Today’s session is expected to be highly volatile due to the release of key US economic data, including the Federal Interest Rate Decision, Federal Reserve Statement, Federal Reserve Chairman’s Press Conference, and the Federal Reserve Economic Outlook. These events could significantly impact market direction.

Given the ongoing trade tensions and the potential for sharp fluctuations, risk remains elevated, making multiple scenarios possible.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations