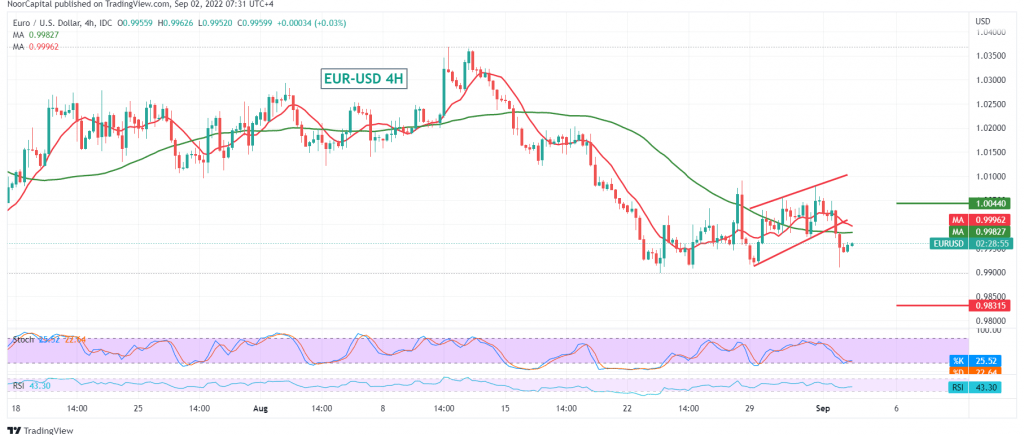

After several consecutive sessions in which we committed ourselves to neutrality due to conflicting technical signals and trading within a narrow sideways range between 0.9980 and 1.0050, and after several attempts by the euro to consolidate against the dollar, yesterday’s trading witnessed a bearish tendency. We pointed out that breaking 0.9980 would facilitate the task required to visit 0.9910, as the pair recorded its lowest level at 0.9910.

Technically, the simple moving averages returned negative pressure on the pair from above, in addition to stabilizing intraday trading below 0.9990.

Therefore, the chances of resuming the decline and controlling the bearish trend are still valid, provided that we witness a break of the strong demand point 0.9910 and, most importantly, 0.9895, which extends the descending wave so that we are waiting for 0.9830 and 0.9750 next price stations.

The suggested scenario requires the intraday trading to remain below 1.0040 and, in general, below 1.0080, taking into consideration that the overshoot and consolidation above 1.0080 can stop the bearish trend temporarily and make the euro to enter the formation of an ascending wave whose targets start at 1.0120 and 1.0180 and may extend later to visit 1.0220.

Note: The US NFP, unemployment rate data and average wages are due for release today in the USA, and they have a big impact we may see price fluctuations; all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9895 | R1: 1.0040 |

| S2: 0.9830 | R2: 1.0120 |

| S3: 0.9750 | R3: 1.0180 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations