The Euro/Dollar pair experienced predominantly negative trading dynamics in the previous session, influenced notably by the decisions of the European Central Bank, marking its lowest point at 1.0820.

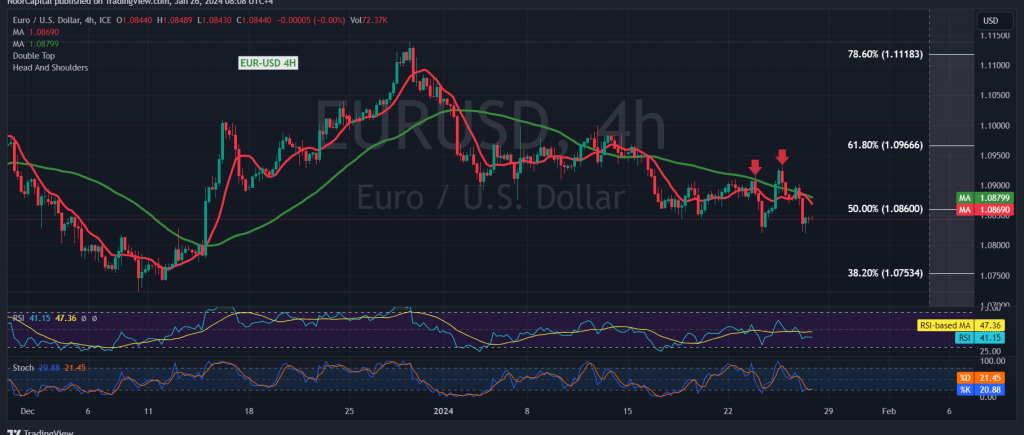

In terms of technical analysis today, a detailed examination of the 4-hour timeframe chart reveals the pair’s intraday trading stability below the breached support level of 1.0860, marked by the 50.0% Fibonacci retracement. Additionally, negative pressure persists due to the influence of the simple moving averages exerting downward force from above.

Given the current conditions, maintaining trading below 1.0860, especially below the critical resistance level of 1.0890, could signal a continuation of the downward trend. In such a scenario, downside targets commence at 1.0810, and it’s noteworthy that the official target lies within the range of 1.0875 to 1.0865.

However, a reversal of the trend may occur if the pair manages to cross above 1.0890 and consolidates its position at this level. Such a scenario could postpone the likelihood of a decline, leading to a retest of 1.0935 and 1.0970, the latter representing the 61.80% Fibonacci retracement level.

Investors and traders will closely monitor these key levels and potential trend reversals to make informed decisions in response to the evolving market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations