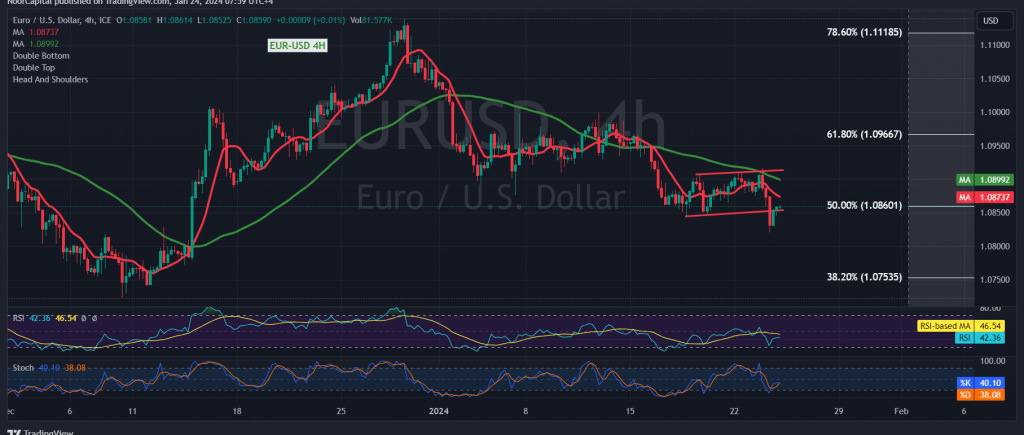

The EUR/USD pair experienced a significant decline in the previous trading session. In the last technical report, a neutral stance was maintained due to conflicting technical signals. It was emphasized that a drop below 1.0860 would exert negative pressure on the euro, targeting 1.0800, and indeed, it reached its lowest level at 1.0820.

Examining the current technical landscape, the ongoing movements indicate a retest of the previously broken support at the price of 1.0860, represented by the 50.0% Fibonacci retracement on the chart. The simple moving averages continue to exert downward pressure on the price, and the Stochastic indicator has lost its upward momentum.

Therefore, with sustained trading below 1.0890 and, more importantly, 1.0910, the prevailing outlook favors further downward movement, targeting 1.0815 as the initial objective. A breach of this level would extend the pair’s losses, opening the path directly toward 1.0765, a significant support level.

Conversely, an upward cross and surpassing 1.0910 would indicate a potential recovery for the pair, with a target of 1.0960, which corresponds to the 61.80% Fibonacci retracement. Subsequent gains could reach 1.1000.

Caution is advised as the market awaits high-impact economic data from the American, French, German, and British economies, including the preliminary readings of the services and manufacturing PMI indices. Additionally, the Canadian interest rate decision and the Bank of Canada press conference are scheduled, potentially leading to high volatility upon their release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations