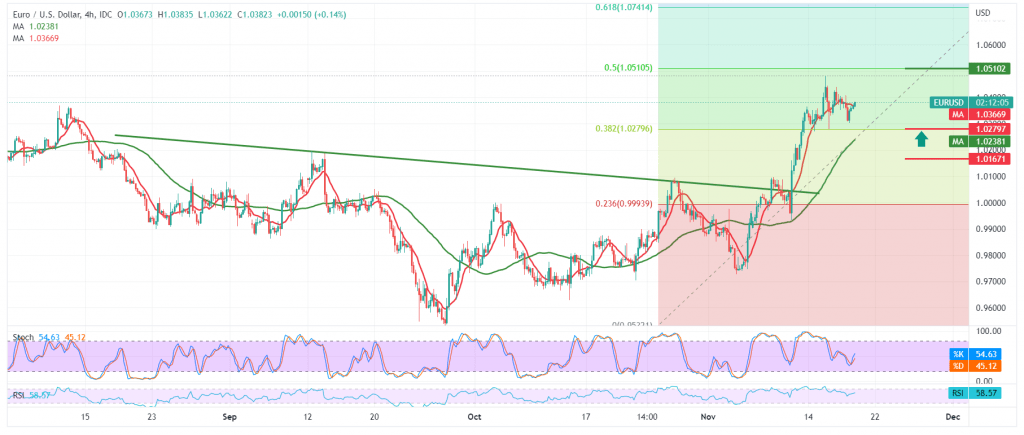

For the second session in a row, the movements of the Euro-dollar pair did not witness a significant change within a limited bearish tendency that dominated the pair’s movements yesterday, to retest the support level of the psychological barrier 1.0300, maintaining the positive stability above.

On the technical side, on the 240-minute timeframe, we find the 50-day Simple Moving Average still supporting the possibility of an upside and holding the price from below, in addition to Stochastic’s attempts to eliminate the current negativity.

We tend to rise, but with caution, relying on the consolidation of daily trading above the pivotal support floor 1.0280/1.0270, represented by Fibonacci 38.20%, as shown on the chart, targeting 1.0420 as the first target, noting that breaching upwards and consolidating above 1.0420 is a must for resuming the upward trend to visit 1.0460 & 1. 0520.

The decline below 1.0270 will immediately stop the suggested bullish scenario and put the EUR/USD pair under negative pressure, with its initial target around 1.0200, and it may extend later towards 1.0170.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0315 | R1: 1.0420 |

| S2: 1.0260 | R2: 1.0460 |

| S3: 1.0205 | R3: 1.0520 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations