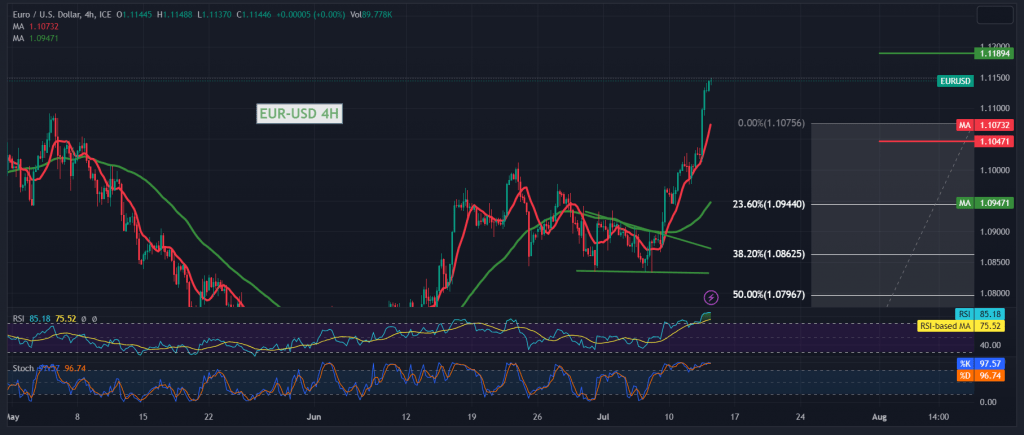

Remarkably positive trades dominated the movements of the euro-dollar pair within the positive technical outlook, as we expected during the previous report, touching the required targets at 1.1100, close by a few pips to the main target 1.1160, recording its highest level at 1.1148.

Technically, and with a closer look at the 4-hour chart, we notice the continuation of the simple moving averages’ defence of the bullish direction, motivated by the clear positive signs on the RSI, which settled above the mid-line 50.

From here, with trading steadily above the resistance of the psychological barrier 1.1100, and in general above 1.1050, that encourages us to keep our positive expectations, continuing towards the third target of the previous report 1.1160, and then 1.1190, the next station, noting that the price’s consolidation above 1.1190 is a catalyst that may enhance the chances of rising towards 1.1245, the official target.

Return of intraday trading stability below 1.1100 postpones the chances of an uprise. Still, it does not cancel it, while the price declining below 1.1050 will immediately stop the bullish trend and put the pair under negative pressure to retest 1.0960 before any attempts to rise.

Note: Today we are waiting for high-impact economic data issued by the US economy, “US inflation data, producer price index” from England, and we are waiting for “Gross Domestic Product”, and we may witness high volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations