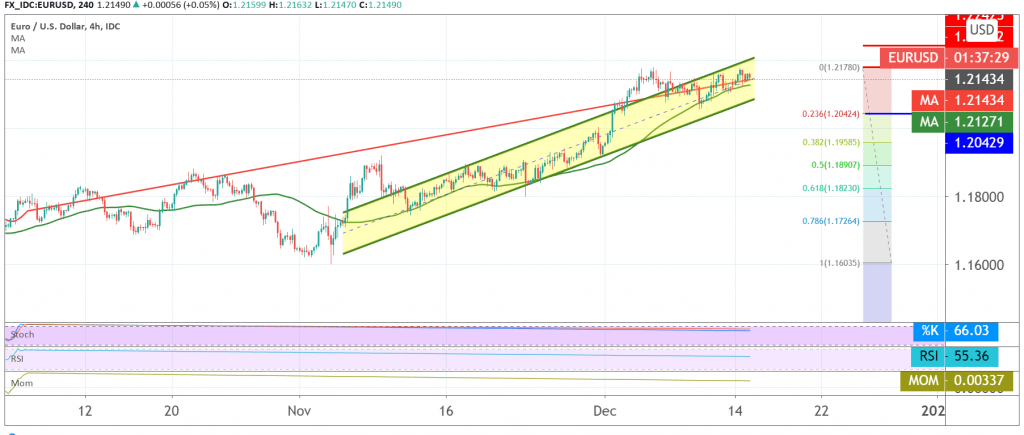

Narrow-range sideways trades dominate the moves of the EUR/USD pair, which consolidate from the top above the support level of 1.2100 and from downside below the resistance level at 1.2180, and the technical outlook has not changed little.

Technically speaking, with a closer look at the 240-min chart, we find positive signs appearing on the stochastic indicator, and we see that the 50-day moving average is still holding the price from below.

Despite the technical factors that support the probability of the rise, we prefer to wait for the clarity of the trend more precisely to be in front of one of the following scenarios:

To confirm the aforementioned daily bullish trend, we need to witness a clear and strong breach of the resistance level 1.2160, and the most important 1.2185, in order to enhance the bullish chances during today’s session and during the week’s trading in general, targeting 1.2220 and then 1.2270 in a row, and targets may extend towards 1.2300.

Reactivating short positions requires a break of 1.2100, which puts the pair under strong negative pressure, its initial targets are around 1.2030 / 1.2040, a 23.60% retracement.

| S1: 1.2100 | R1: 1.2185 |

| S2: 1.2065 | R2: 1.2220 |

| S3: 1.2010 | R3: 1.2270 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations