We adhered to intraday neutrality during the previous report, due to the conflicting technical signals, explaining that activating buying positions depends on consolidation above 1.0510, to enhance the chances of ascending to visit 1.0560.

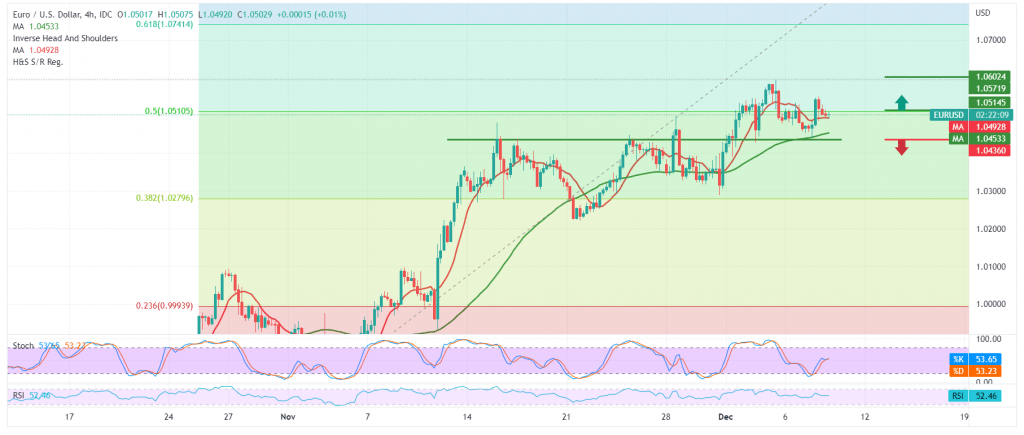

Technically, we find the euro-dollar pair still hovering around the 1.0510 level, which constitutes one of the most important keys to determining the direction today, 50.0% Fibonacci correction, as shown on the 240-minute chart. We find the 50-day simple moving average returning to hold the price from below. , stimulated by the RSI stabilizing above the mid-line.

Despite the technical factors that support the possibility of resuming the rise, we prefer to witness the price consolidation above 1.0510 resistance, and that opens the door to visit 1.0555 as a first target, knowing that crossing the upside of the mentioned level is considered a catalyst that enhances the chances of touching 1.0600, and the gains may extend later towards 1.0640.

Activating the bullish scenario requires the consolidation of daily trading above the strong support level 1.0435, and breaking it would put the price under negative pressure, with its initial target located around 1.0390, and extends to 1.0340.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0445 | R1: 1.0555 |

| S2: 1.0390 | R2: 1.0605 |

| S3: 1.0340 | R3: 1.0660 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations