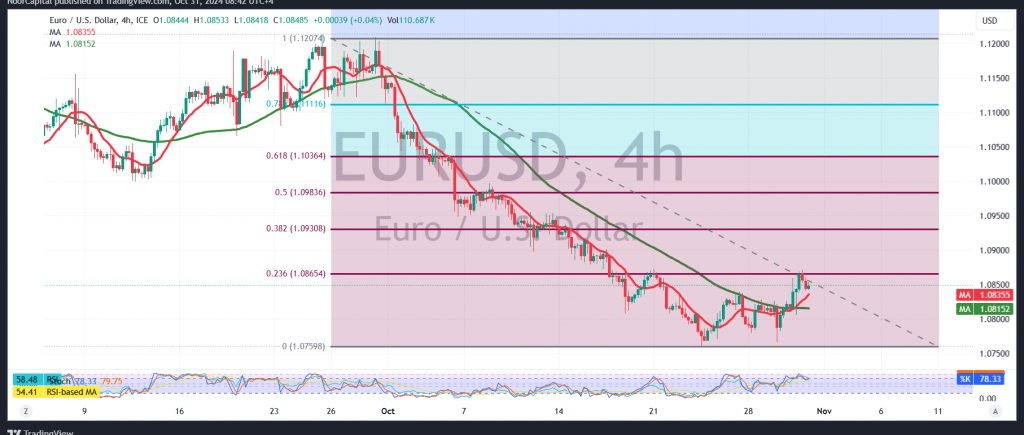

The EUR/USD pair has reaffirmed its 1.0865 resistance level but failed to break through it in the last session.

Technical Analysis:

- A closer look at the 4-hour chart shows that the 50-day simple moving average supports a potential decline, with the stochastic indicator gradually losing upward momentum.

- While technical indicators favor a decline, we prefer to wait for an hourly close below 1.0830 to confirm this move, which would likely open the way towards 1.0800 and then to the official target of 1.0760. A break below 1.0760 would pave the way for a deeper retracement toward 1.0700.

- Conversely, if the pair breaks above the 1.0870 resistance level, corresponding to the 23.60% Fibonacci correction, it may signal a short-term recovery with a target of 1.0930.

Warnings:

Given ongoing geopolitical tensions, the risk level remains high, and all scenarios are possible.

High-impact economic data from the US is expected today, including Core Personal Consumption Expenditure Prices, Unemployment Benefits, and the Employment Cost Index, which may result in significant price volatility at the time of the news release.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations