Despite a limited bearish bias during yesterday’s session, the EUR/USD pair rebounded into positive territory in early trading today, finding support at the 1.1270 level — as highlighted in the previous technical report.

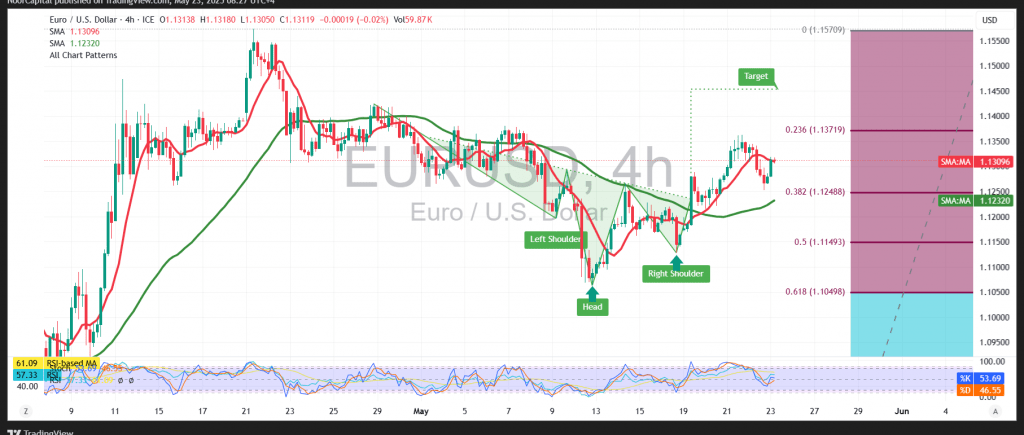

On the 4-hour chart (240-minute timeframe), the pair remains above the psychological barrier at 1.1300, supported by simple moving averages that are acting as dynamic support levels. These technical foundations are further reinforced by positive signals from the Relative Strength Index (RSI), which indicate strengthening bullish momentum.

Given these conditions, the technical setup supports the potential for further upside. A confirmed breakout above 1.1370—which aligns with the 23.6% Fibonacci retracement—would likely accelerate bullish momentum, opening the path toward the next resistance target at 1.1410.

However, a one-hour candle close below 1.1270 would weaken the bullish case and could trigger a short-term correction, with downside targets at 1.1240, followed by 1.1200, before any potential recovery.

Risk Disclaimer:

In light of persistent global trade tensions and broader macroeconomic uncertainty, market risk remains high. Traders should remain cautious and be prepared for heightened volatility and rapid directional changes.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations