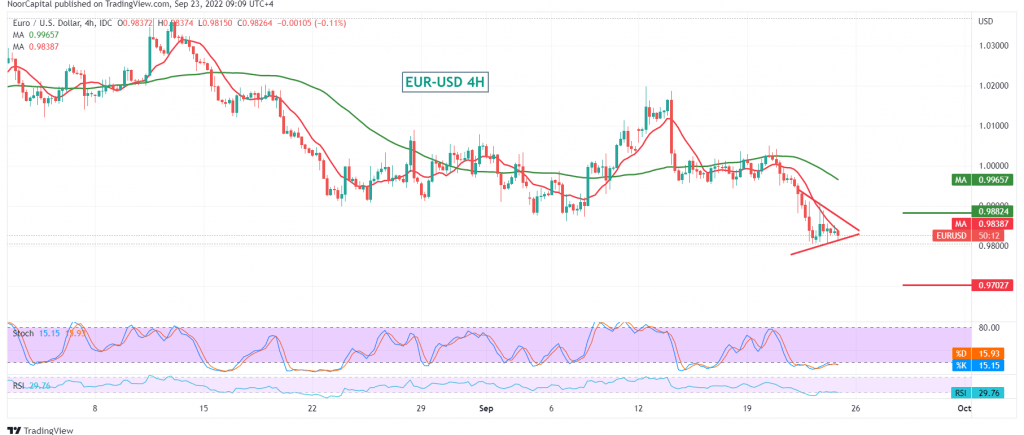

The resistance levels published during the previous analysis, at 0.9900, managed to limit the temporary rise witnessed by the EUR/USD pair yesterday, to return to trading negatively within the expected bearish path.

On the technical side, and carefully looking at the 240-minute chart, we find a bearish technical structure that supports the continuation of the decline, in addition to the price stability below the 50-day simple moving average, which meets around 0.9885 and adds more strength to it.

Therefore, the bearish scenario will remain valid and effective, targeting 0.9785, considering that breaking the mentioned level will extend the pair’s losses so we will wait for 0.9745 and 0.9710 consecutive stations.

To remind that consolidation above 0.9900 postpones the chances of a rise and leads the pair to recover temporarily to retest 0.9950 initially.

Note: We are awaiting the Federal Reserve’s speech later in today’s session and may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9785 | R1: 0.9885 |

| S2: 0.9745 | R2: 0.9950 |

| S3: 0.9685 | R3: 0.9990 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations