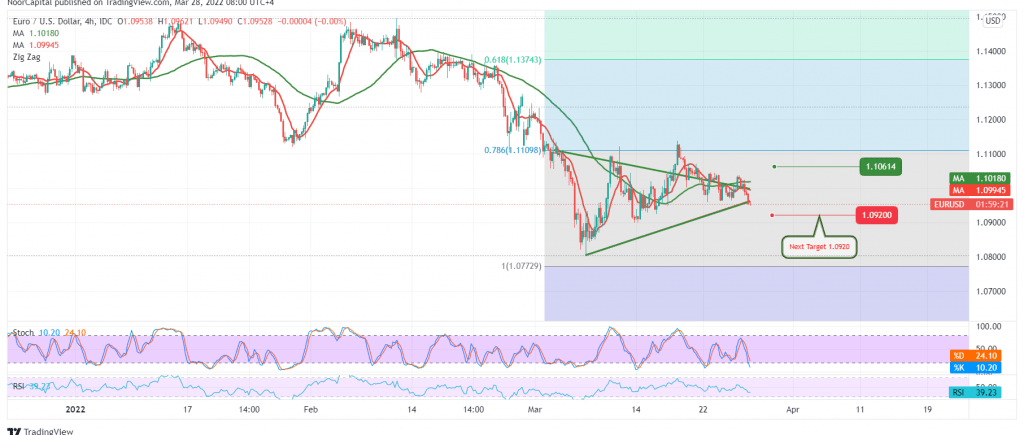

The single European currency opened its first weekly trading with a bearish bias after failing to breach the strong supply area published during the last analysis at 1.1060. It represents one of the most important directional keys that forced the pair to retest 1.0950.

Technically, the current movements of the pair settle near the lowest level during the morning trading at 1.0950. However, with careful consideration of the 4-hour chart, we notice the price stability below the 50-day simple moving average, which meets around the 1.1030 level and adds more strength to it—the stability of the momentum indicator below the mid-line 50.

Therefore, the possibility of continuing the decline is still intact to visit 1.0920, awaiting station, noticing that the decline below it increases and accelerates the strength of the daily bearish trend, opening the door for the euro to visit 1.0890 and 1.0840, respectively.

The attempt to consolidate again above 1.1030, and most importantly 1.1060, may nullify the suggested bearish scenario, and the euro may recover with a target of 1.1100.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0920 | R1: 1.1010 |

| S2: 1.0890 | R2: 1.1065 |

| S3: 1.0835 | R3: 1.1105 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations