The single European currency retreated during the previous session’s, nullifying the positive outlook, as we expected, in which we relied on trading stability above 1.2280, as a reminder that we mentioned in the previous report that any attempts to break the aforementioned support level will immediately stop the bullish tendency and put the price under negative pressure targeting a retest of 1.2230 to record Its lowest level was at 1.2235, offsetting long position losses.

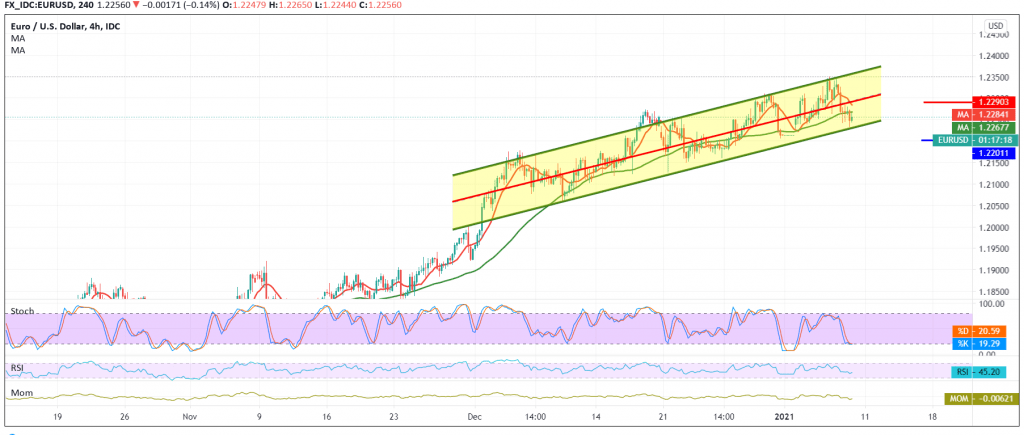

Technically, and with a closer look at the 4-hour chart, we find the current trading is stable below 1.2280, and the simple moving averages have begun to pressure the price from the top.

Consequently, the chances of a reversal will be there with the first target of 1.2220 / 1.2210, bearing in mind that trading below 1.2200 will extend the pair’s losses to complete the downside path towards 1.2170.

From the top, rising again above 1.2280, and most importantly 1.2325 negates the suggested bearish scenario, and the euro regains its recovery to resume the official bullish path with the target of 1.2390.

Note: Today we are awaiting the US employment data are due today and may affect the price.

| S1: 1.2215 | R1: 1.2325 |

| S2: 1.2170 | R2: 1.2390 |

| S3: 1.2110 | R3: 1.2430 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations