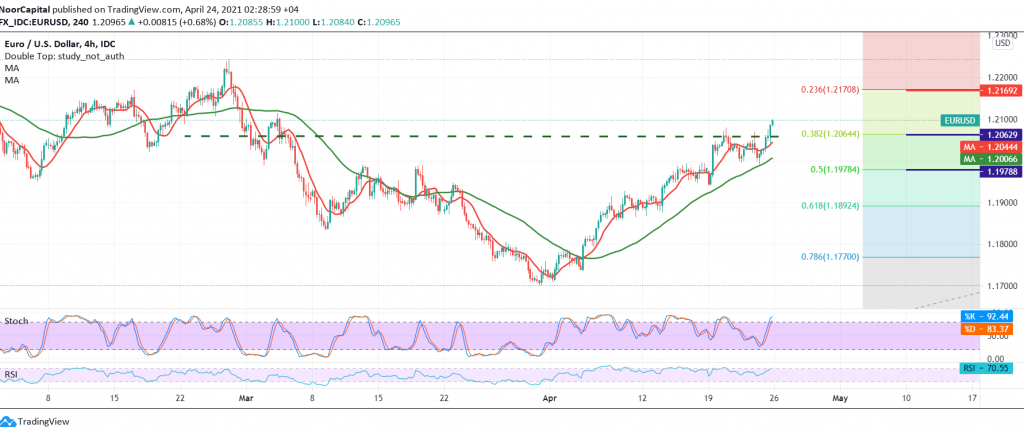

Positive trades returned to control the euro’s movements against the US dollar, benefiting from the confirmation of the breach of the 1.2060 resistance level, making it clear in the previous analysis that once trading above the aforementioned level, the pair will able to enhance the chances of upside to visit our desired target 1.2110, to reach its highest level at the end of week’s trading 1.2110.

Technically speaking, with the euro’s success in intraday stability above the previously breached resistance, which has now turned to the support level of 1.2060, 38.20% correction, increases the probability of a bullish move, in addition to the positive motivation of the simple moving averages that support the upside trend.

Consequently, we hold onto our positive outlook, continuing towards 1.2130/1.2135, a first target, and then 1.2170 a 23.60% retracement, a next stop.

The suggested bullish scenario above requires stability above 1.2060 and in general above 1.2000, and breaking the latter delays the chances of an upside and puts the pair under negative pressure, targeting a re-test of 1.1970.

| S1: 1.2030 | R1: 1.2135 |

| S2: 1.1960 | R2: 1.2170 |

| S3: 1.1920 | R3: 1.2240 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations