The single European currency continues its attempts to rise against the US dollar within the expected gradual ascent, recording its highest price during the last trading session, 1.1845.

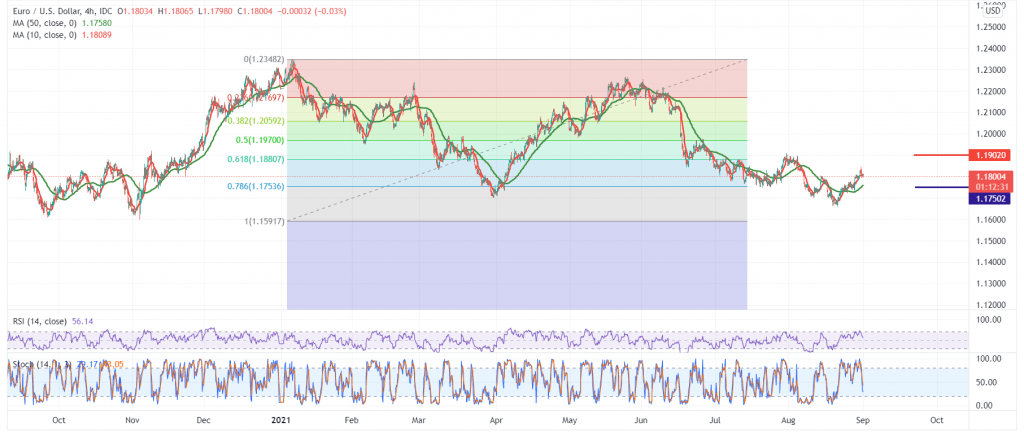

On the technical side, the current movements are witnessing a bearish slope due to the negative features that started appearing on the stochastic indicator as a result of intraday overbought, in addition to the negative pressure coming from the 50-day moving average on the short time frames.

Therefore, the pair may witness a bearish bias in the coming hours to retest 1.1750 before attempts to rise again.

Note: the slight bearish bias does not contradict the bullish trend, whose targets are still around 1.1880, 61.80% correction, unless we witness a clear and robust break below 1.1750, as it will stop the attempts to rise and put the price under negative pressure, with its initial target of 1.1700.

| S1: 1.1750 | R1: 1.1835 |

| S2: 1.1700 | R2: 1.1885 |

| S3: 1.1665 | R3: 1.1940 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations