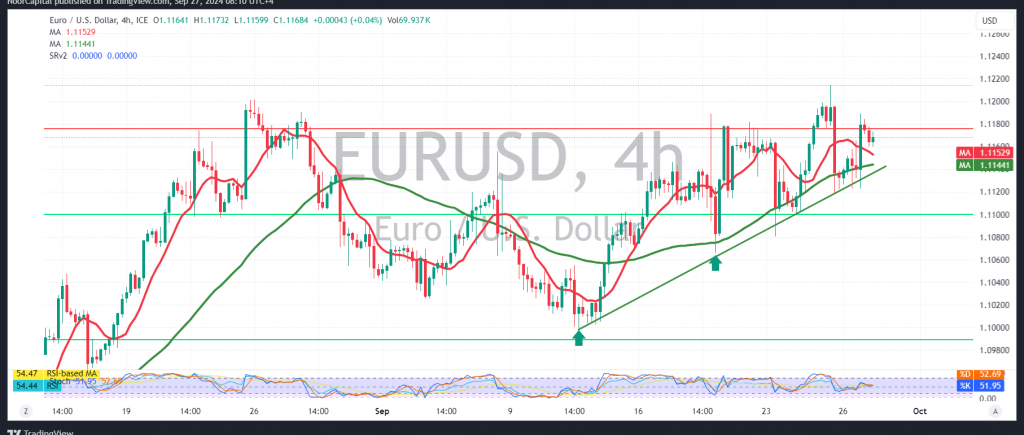

The euro experienced limited positive attempts against the US dollar, trying to break through the psychological resistance level of 1.1200, reaching a high of 1.1189.

From a technical perspective today, we notice that the pair has struggled to stabilize temporarily above the 1.1200 resistance level, acting as a temporary obstacle. Upon examining the 240-minute chart, the Stochastic indicator shows signs of trying to eliminate negative signals, while the pair seeks a positive boost from the 50-day simple moving average.

As long as daily trading remains stable above the strong support level of 1.1100, the upward trend remains valid and effective. A break above the 1.1200 resistance level would likely strengthen and accelerate the upward trend, paving the way towards 1.1250 as the first target, and then 1.1300 as the anticipated station.

However, it’s important to note that a confirmed break below 1.1100, and more importantly below 1.1095, would invalidate the bullish scenario, placing the pair under negative pressure with the aim of retesting 1.1065 and 1.1030 respectively.

Warning: Today, we expect high-impact economic data from the US, specifically “Core Personal Consumption Expenditure Prices – Annual,” which could lead to significant price volatility at the time of the news release.

Warning: The risk level is high amid ongoing geopolitical tensions, and all scenarios are possible.

Risk Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations