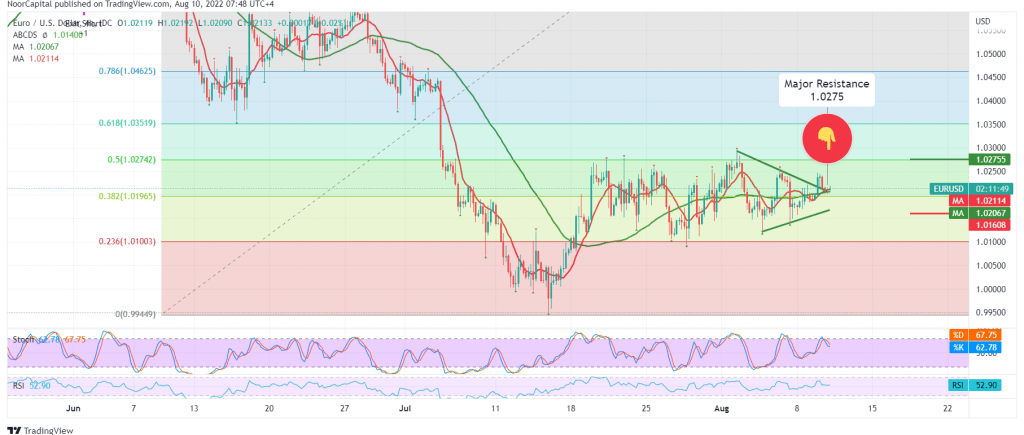

We adhered to intraday neutrality during the previous session due to the conflicting technical signals to see the euro challenging to surpass the minor resistance level published during the last report represented by the price of 1.0240, which limited the bullish bias.

Technically, signs of negativity began to appear on the stochastic. We find the pair stable below the 50-day simple moving average, which meets around the 1.0245 resistance level and adds more strength.

The possibility of negativity remains in the coming hours, with the intraday trading remaining below 1.0245 and below the pivotal resistance 1.0275, 50.0% Fibonacci correction, aiming to retest the ascending channel’s support line at 1.0160/1.0170.

The pair’s consolidation above 1.0275 can completely thwart the proposed scenario and lead the pair to regain the bullish path with an initial target of 1.0300, and after 1.0350 Fibonacci correction of 61.80%.

Note: CPI figures are due during the US session.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0160 | R1: 1.0275 |

| S2: 1.0100 | R2: 1.0300 |

| S3: 1.0065 | R3: 1.0355 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations