The single European currency ended its weekly trading with a decline with the rise of the US dollar, which received support from the positive US employment data, as the EUR/USD pair recorded as low as 1.0140.

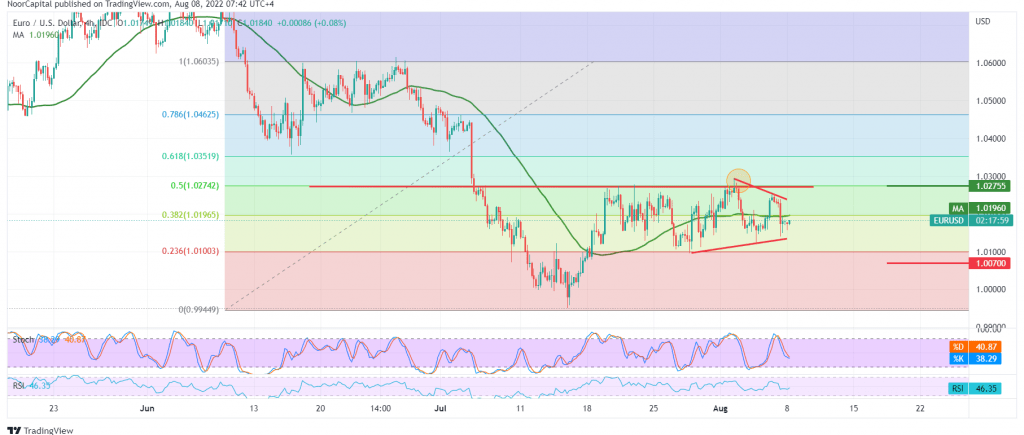

Technically, by carefully looking at the 240-minute chart, we notice the price stability below the 50-day simple moving average, as we find the stochastic is trading negatively, in addition to strength below the pivotal resistance 1.0275 represented by the 50.0% Fibonacci correction as shown on the above chart.

Although we tend to be negative, we prefer to witness a clear and strong break of the 1.0130/1.0140 support floor, and that might facilitate the task required to visit 1.0080, a first target, and gains may extend later towards 1.0030 as long as the price is intraday stable below 1.0240, and most importantly 1.0275.

Consolidation above 1.0275, 50.0% correction, is able to thwart the suggested bearish scenario, and the euro is witnessing a temporary recovery against the dollar, with initial targets of 1.0300 and 1.0350.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0130 | R1: 1.0275 |

| S2: 1.0080 | R2: 1.0300 |

| S3: 1.0020 | R3: 1.0355 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations