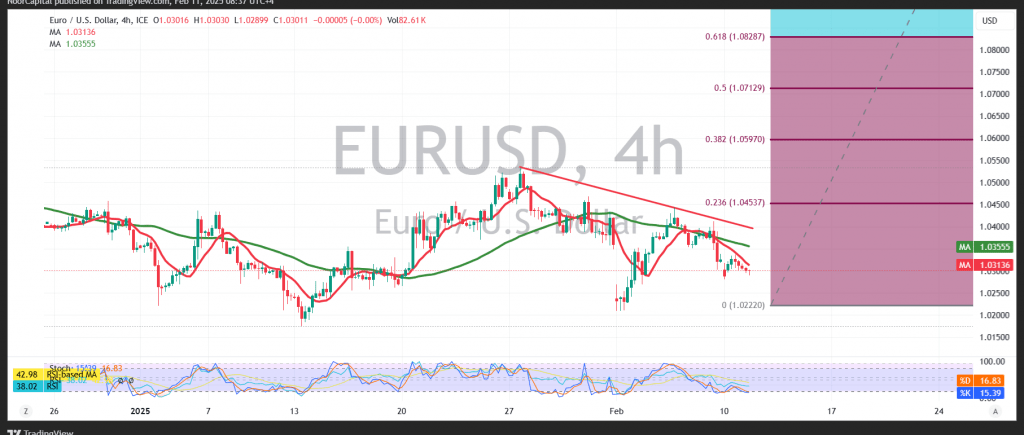

The U.S. dollar pair has shown a slow trend, recording its lowest level at 1.0280 in recent sessions.

Technical Outlook:

- 4-hour chart analysis indicates that there is no significant downside pressure, with only minor bearish signals.

- The Stochastic Momentum Indicator suggests a potential for improvement in price movement.

Key Levels to Watch:

- Bearish Scenario:

- A steady decline below 1.0335 and 1.0345 could reinforce downside pressure.

- The first target is 1.0275, and breaking this level could extend losses toward 1.0220.

- Bullish Scenario:

- A breakout above 1.0345, especially with a confirmed candle close, could support an upward trend.

- The next upside targets would be 1.0420 and 1.0450, corresponding to the 23.60% Fibonacci retracement level.

Market Risks & Considerations:

- High-impact events are expected today, particularly Federal Reserve Chairman Jerome Powell’s speech, which could lead to sharp market movements.

- Heightened volatility may cause sudden fluctuations in the pair’s direction.

⚠ Risk Warning: Market uncertainty remains high due to ongoing economic and geopolitical factors, making all scenarios possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations