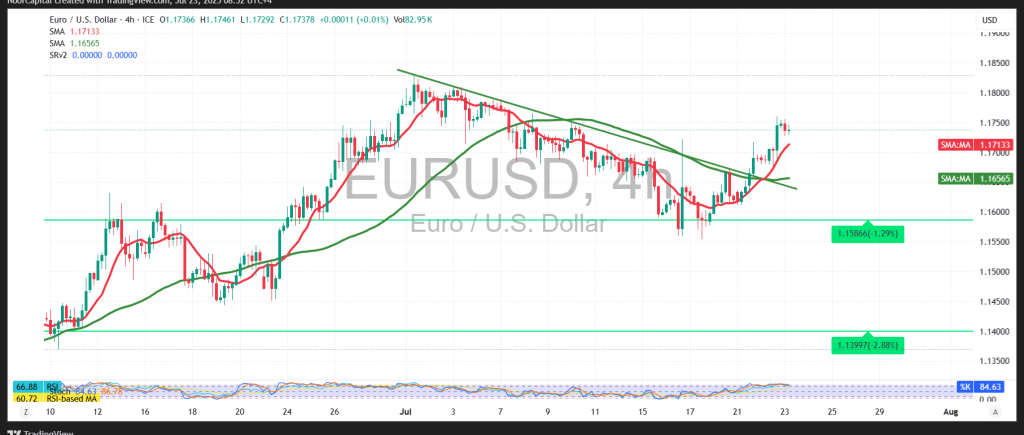

EUR/USD Technical Analysis – 4-Hour Chart

The EUR/USD pair has posted solid gains in recent trading, in line with earlier bullish technical expectations. The pair successfully reached the first target at 1.1740 and approached the official target at 1.1770, recording a high of 1.1760.

Technical Outlook – 4-Hour Timeframe:

Price action shows a mild bearish bias in the short term, as the pair tests the strong resistance zone near 1.1750. However, the 50-period Simple Moving Average (SMA) continues to act as dynamic support, keeping the broader bullish structure intact. Meanwhile, the Relative Strength Index (RSI) is signaling a corrective pullback as it moves away from overbought territory, potentially clearing the way for a new wave of upward momentum.

Proposed Technical Scenario – Bullish Continuation:

The uptrend remains favored as long as the pair stays above 1.1690, and more broadly above 1.1675. A clear break above 1.1750 would confirm the resumption of bullish momentum, paving the way for:

- 1.1770 as the next resistance

- 1.1805 as a subsequent target

Alternative Scenario – Short-Term Pullback:

A break below 1.1670 would likely trigger a temporary halt to the uptrend, exposing the pair to downside pressure toward:

- 1.1645, followed by

- 1.1605

Caution:

Risk levels remain elevated due to ongoing trade tensions and macroeconomic uncertainty. All scenarios are possible, and disciplined risk management is essential.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations