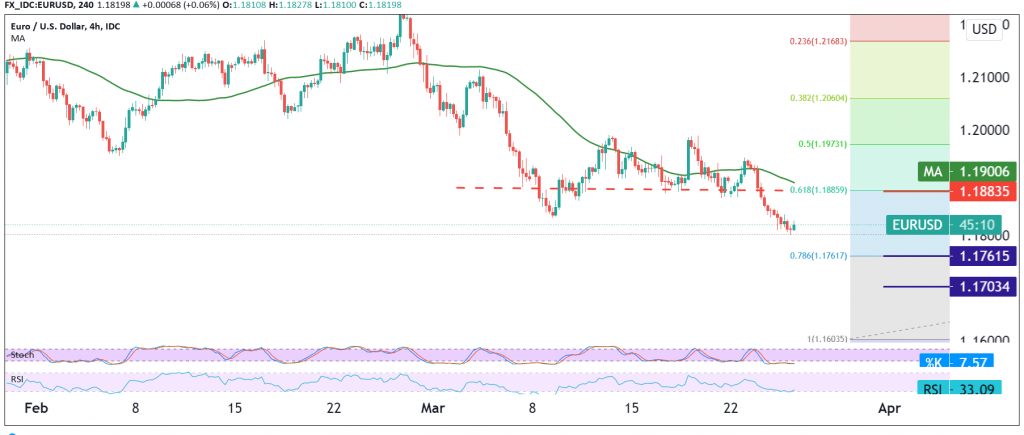

The single European currency continued to decline against the US dollar within the expected bearish path mentioned in the previous analysis, touching our required target located at 1.1800, to record its lowest level at 1.1806.

On the technical side, today, and with a closer look at the 4-hour chart, the simple moving averages are still pressing the price from the top, in addition to the intraday stability below the 1.1850/1.1860 resistance level.

Therefore, we will maintain our negative outlook, knowing that confirming the breach of the 1.1800 psychological barrier support level will facilitate the task required to visit 1.1770, a next station that may extend its targets later to 1.1720.

From the top, to move upwards and rise above 1.1885, a 61.80% correction delays the chances of a reversal, but does not cancel them.

In general, we will continue favoring the downside as long as trading remains stable below 1.1975, Fibonacci 50.0%.

| S1: 1.1800 | R1: 1.1855 |

| S2: 1.1770 | R2: 1.1885 |

| S3: 1.1710 | R3: 1.1930 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations