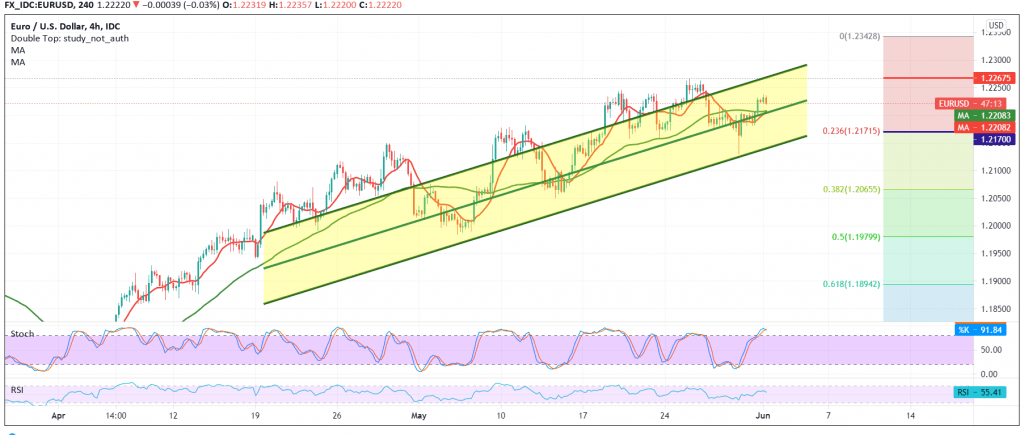

The single European currency started its first weekly trading on an upward trend after it succeeded in building a support level at 1.2170, to record its highest level during the early trading of the Asian session at 1.2236.

Technically, and with careful consideration of the 4-hour chart, we find the 50-day moving average continuing to hold the price from below, in addition to the RSI’s gaining bullish momentum on the short time frames.

Therefore, we tend in our trading to the positive, knowing that the breach of 1.2245 reinforces the idea of the continuation of the rise to visit 1.2270, and then 1.2300 official station awaited.

From below, trading stability below 1.2170, located around the 23.60% Fibonacci correction, will immediately stop the bullish bias and put the Euro under strong negative pressure within a bearish corrective slope with official target is to retest 1.2065, 38.20% correction.

| S1: 1.2180 | R1: 1.2245 |

| S2: 1.2140 | R2: 1.2265 |

| S3: 1.2105 | R3: 1.2310 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations