The Euro extended its gains during the previous trading session, surpassing the target of 1.0715 and reaching a high of 1.0853.

Technical Outlook

- Bullish Support:

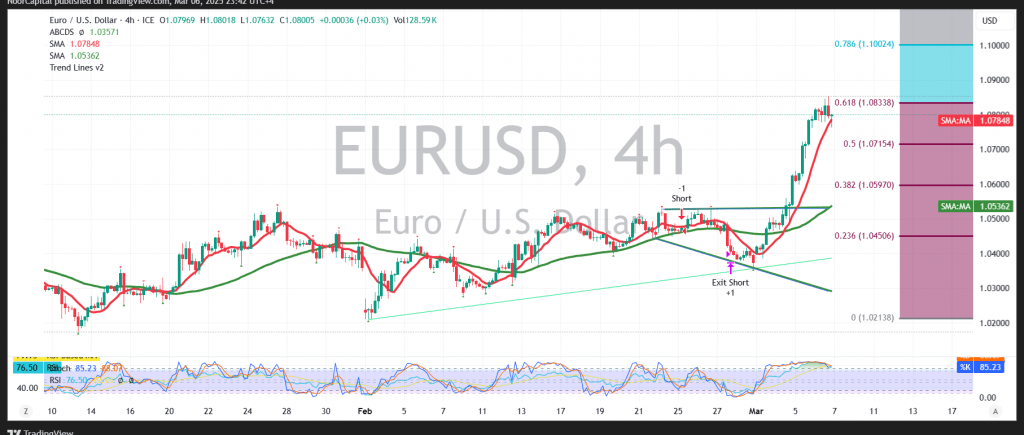

- On the 4-hour chart, the simple moving averages continue to support the daily upward trend.

- Intraday trading remains stable above the resistance level of 1.0715—now serving as support—located around the 50.0% Fibonacci retracement level.

- Potential Upside:

- The bullish scenario appears intact as long as trading remains above 1.0715.

- A break above 1.0830 (the 61.80% Fibonacci level) could pave the way for a move toward 1.0895 as the next target, with further gains potentially extending to 1.0920.

- Bearish Contingency:

- Conversely, if trading falls below 1.0715 with an hourly candle close, the downward trend could resume, potentially leading to a retest of 1.0645.

Risk Warning

- Economic Data Impact:

- Today’s release of high-impact US economic data—US non-farm payrolls, unemployment rates, and average wages—may generate significant volatility.

- Market Uncertainty:

- Ongoing trade tensions and other risks mean that multiple scenarios remain possible.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations