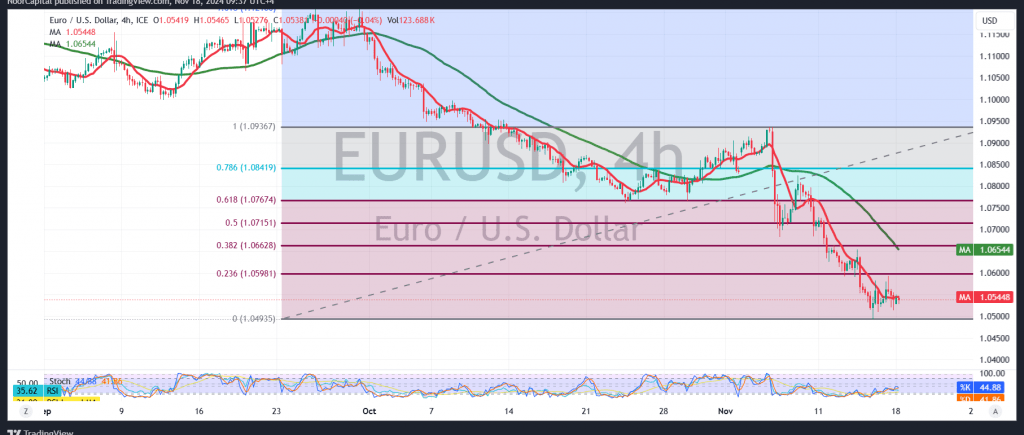

The US dollar continues to exert downward pressure on the euro, hitting the first official target highlighted in the previous technical report at 1.0510, with a recorded low of 1.0515.

From a technical standpoint, and based on a closer analysis of the 4-hour chart, the pair remains stable below the resistance level of 1.0580 and more critically below the psychological barrier of 1.0600, which coincides with the 23.60% Fibonacci retracement level. Additionally, the simple moving averages continue to exert downward pressure from above, reinforcing the negative momentum.

Consequently, we anticipate that the downtrend will persist, with a renewed target of 1.0510. A decisive break below this level would likely accelerate the bearish momentum, paving the way for a move towards 1.0470, and potentially extending losses to 1.0400, which stands as a significant expected target.

However, if the pair manages to break and stabilize above the 1.0600 resistance level, the bearish outlook may be temporarily postponed, with a possible upward retracement aiming for 1.0670.

Warning: The risk level remains elevated due to ongoing geopolitical tensions, making all scenarios possible. Proceed with caution.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations