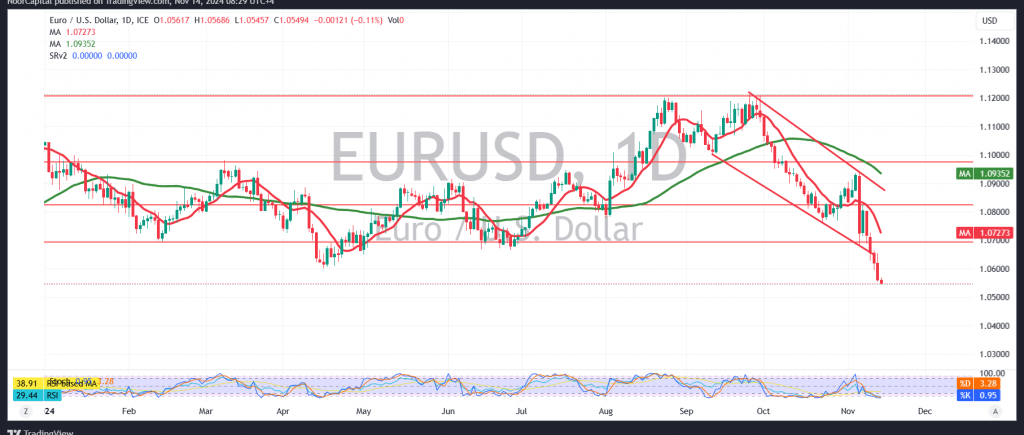

The Euro remains firmly in a downtrend against the US Dollar, as we had anticipated, reaching our previous target of 1.0565 and even dipping to a low of 1.0545 during the morning trading session.

On the technical front, the 4-hour chart indicates persistent negative pressure from the simple moving averages, which continue to act as resistance. Additionally, daily trading remains below the key resistance level of 1.0650, reinforcing the bearish outlook.

Consequently, we anticipate further declines, with the next target set at 1.0510. A confirmed break below this level would intensify and accelerate the downtrend, paving the way for a move toward 1.0470. Beyond this, losses could extend to the major support level of 1.0400.

However, should the pair manage to break above the 1.0650 resistance, it would temporarily reduce bearish momentum. In such a scenario, we could see recovery attempts, aiming to retest 1.0700 and potentially 1.0730.

Caution: Today’s release of high-impact US economic data, including the “Producer Price Index – Annual, Producer Price Index – Monthly, and Weekly Unemployment Claims,” could lead to significant price volatility.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations