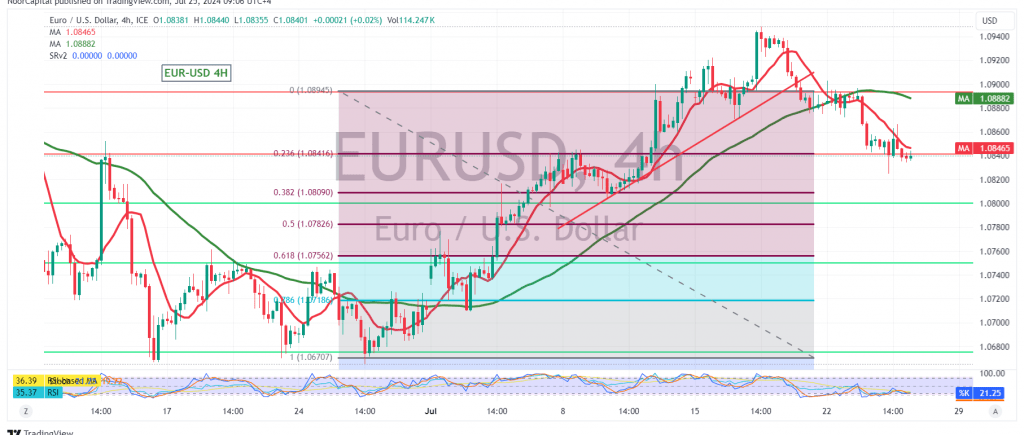

The euro continues to decline against the US dollar, adhering to the expected bearish trend after reaching the first target of 1.0840 as indicated in the latest report.

Technically, the 240-minute chart reveals negative crossover signals from the simple moving averages, which support the likelihood of continuing the downward trend. Additionally, the 14-day momentum indicator shows clear negative signals.

There is a potential for the euro to resume its downward correction, with a possible move towards 1.0810, which corresponds to the 38.20% Fibonacci retracement level. A drop below this level could extend the decline, targeting 1.0775, the next key support, representing the 50.0% retracement.

On the upside, a return to trading stability above 1.0880 could signal a recovery, potentially leading to a positive trading session with an initial target of 1.0950.

Warning: Today’s trading session may experience high price volatility due to the release of significant economic data from the American economy, including the preliminary reading of GDP – annual revenues, and weekly unemployment benefits.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations