Positive moves dominated the euro against the US dollar during the previous trading session. To remind us, we mentioned in the last report that the attempt to breach the resistance level at 1.2115 paves the way for the pair to retest the pivotal resistance level of 1.2175, recording a high of 1.2177.

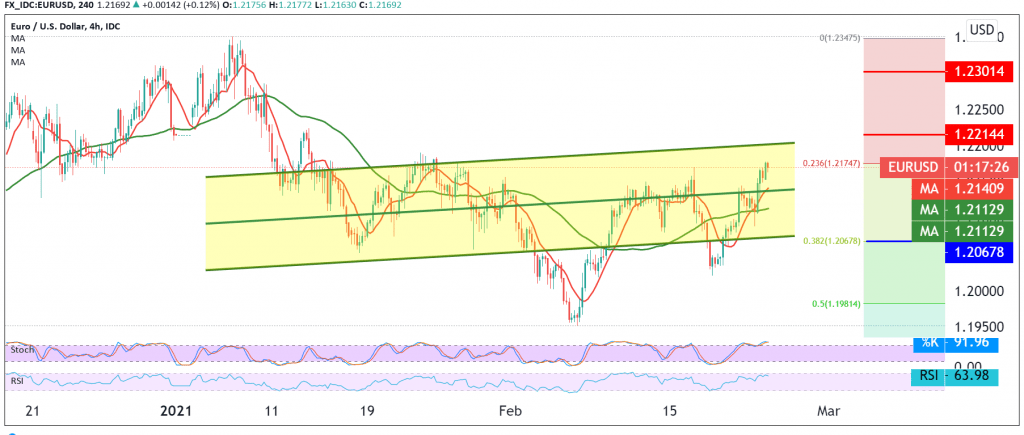

Technically speaking, the pair succeeded in confirming the breach of 1.2115, which was accompanied by the positive motivation of the 50-day moving average, which was accompanied by positive signs coming from the RSI.

This increases the probability of continuing the advance to target 1.2200, bearing in mind that trading above the psychological barrier of 1.2200 is a catalyst that increases the probability of continuing the rise to 1.2290 the next leg.

From the bottom, trading again below 1.2090 will immediately stop the bullish scenario and put the price under negative pressure, aiming to re-test 1.2065 Fibonacci retracement of 38.20% as shown on the chart.

Note: Stochastic is trading around overbought areas.

| S1: 1.2110 | R1: 1.2200 |

| S2: 1.2065 | R2: 1.2335 |

| S3: 1.2020 | R3: 1.2285 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations