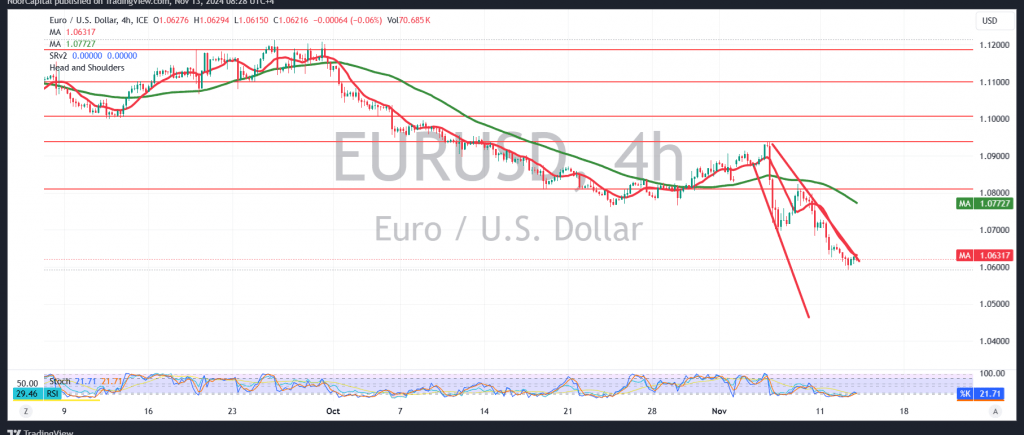

The Euro continues to decline, pressured by the strengthening US dollar. The pair reached the initial target outlined in our previous report at 1.0600, with the lowest recorded level at 1.0595.

From a technical perspective, examining the 240-minute chart reveals persistent negative pressure from the simple moving averages, which act as a resistance barrier. This coincides with daily trading stability below the resistance level of 1.0660, and more broadly, under the key psychological resistance at 1.0700.

Given these factors, we maintain our bearish outlook, targeting the next level at 1.0565 as highlighted in the prior report. A break below this point could expose the pair to stronger downside pressure, opening the door for a potential move towards 1.0520.

It’s important to note that a confirmed break above the 1.0665 resistance level would temporarily reduce the likelihood of further declines. In such a case, we could see recovery attempts in the short term, with the pair aiming to retest 1.0700 and potentially 1.0760.

Caution: Today’s economic calendar includes high-impact data from the US, specifically the “Consumer Price Index – Annual and Monthly.” This could lead to significant market volatility at the time of release.

Risk Alert: Market risk remains elevated due to ongoing geopolitical tensions, making all scenarios possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations