Quiet negative trading dominated the movements of the EUR/USD pair amid the holiday in the American markets at the beginning of this week’s trading, with the euro maintaining negative stability against the US dollar, recording its lowest level at 1.0771.

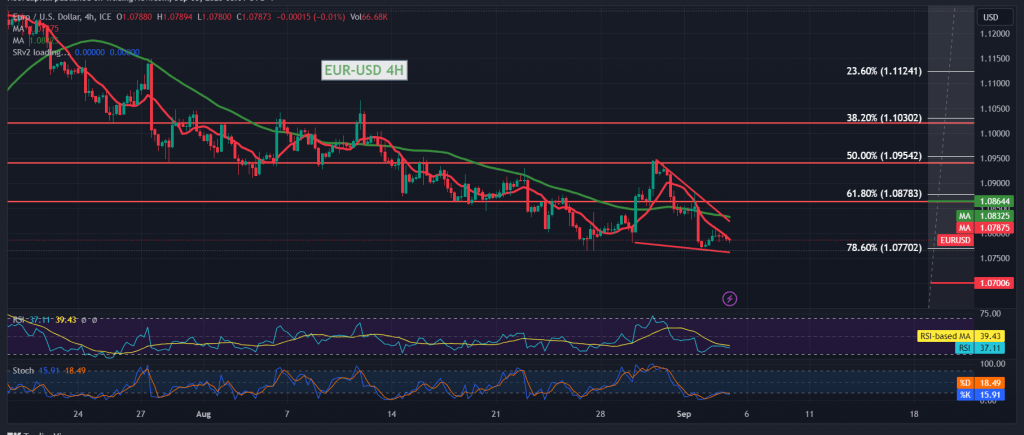

Technically, by looking at the 4-hour time frame chart, we find that the negative pressure continues from the simple moving averages, and the 50-day average meets near the 1.0855 resistance level, adding more strength.

Therefore, the bearish scenario will remain the most likely during today’s trading session, targeting 1.0745 as the first target and 1.0700, an official station awaited as long as trading remains stable below 1.0855.

Crossing upwards and rising above 1.0855 postpones the chances of a decline, and the pair will recover temporarily to retest 1.0900 and then 1.0955, the 50.0% Fibonacci retracement, as shown on the chart.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations