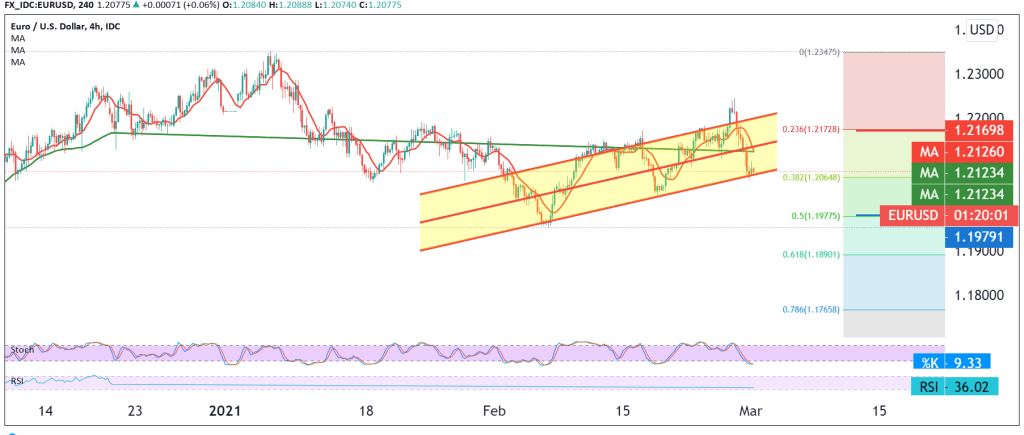

The euro fell against the US dollar, a noticeable decline within the negative outlook expected during the previous analysis, touching the second official target of 1.2065, posting a low of 1.2062.

On the technical side today, and with a closer look at the chart, we find the negative pressure continues from the 50-day simple moving average that meets around the previously broken support level of 1.2120 and adds more strength to it, in addition to the strength of the relative strength index gaining bearish momentum on short time frames.

Therefore, the market maintains our negative outlook, knowing that trading below 1.2065 Fibonacci retracements of 38.20% facilitates the task required to visit 1.2030 the first target, and then 1.1980 a 50.0% retracement.

In general, we will continue to suggest the daily bearish trend as long as trading is stable below 1.2175.

| S1: 1.2030 | R1: 1.2155 |

| S2: 1.1985 | R2: 1.2230 |

| S3: 1.1910 | R3: 1.2275 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations