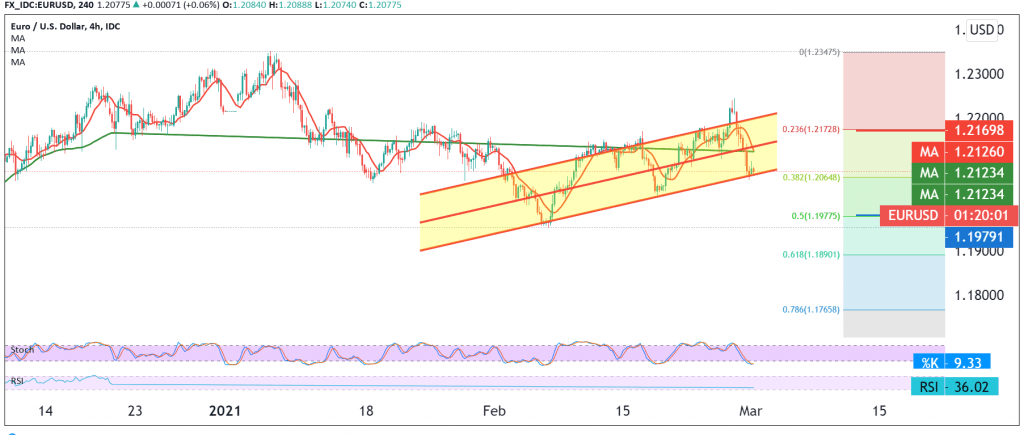

The euro resumed its downward path against the US dollar, as we expected, touching the second target previously reported, located at 1.2020, its lowest level during Asian trading hours for the current session 1.2020.

On the technical side, today the current moves are witnessing stability below the previously broken support level converted to the resistance level of 1.2065, the Fibonacci 38.20% retracement level, and the simple moving averages continue to pressure the price from above.

From here, we will maintain our negative expectations, knowing that confirming the breach of the 1.20000 level will make way for the mission required to visit the awaited target of 1.1975, 50.0% retracement level as a next leg, and breaking it will force the pair to enter a strong bearish wave, the initial target of which is around 1.1920.

From above, the stability of trading again, and surpassing the resistance level 1.2075 would delay the chances of an upside move, but does not eliminate it, and we may witness a re-test of 1.2120 before retreating again.

In general, the trend is to the downside unless trading above 1.2175, a 23.60% retracement level.

| S1: 1.1975 | R1: 1.2075 |

| S2: 1.1920 | R2: 1.2125 |

| S3: 1.1860 | R3: 1.2175 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations