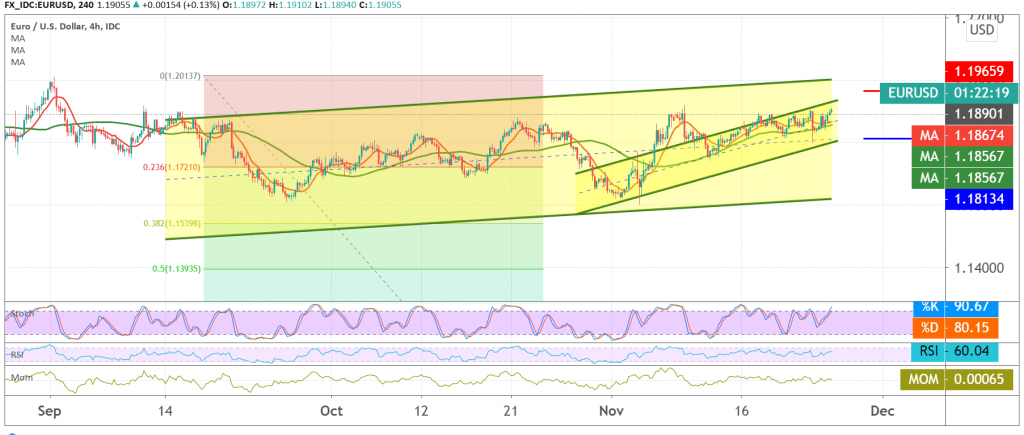

We stayed on the fence in the previous analysis due to the conflict of technical signals, explaining that continuing to activate long positions on the euro-dollar depends on the stability of trading above 1.1820 and the breach of the resistance level of 1.1880 in order to target 1.1920, so that we find the pair opened its trading in a clear positive, recording its highest level during the Asian session at 1.1910 .

Technically, we tend to be positive in our trading, relying on the pair’s intraday stability above 1.1860, in addition to building above support floor of 1.1820, and with a closer look at the chart, we find the RSI stable above the middle line on short intervals.

Thus, the bullish bias is likely today targeting 1.1935 / 1.1940 as a first target, and the breach of the aforementioned level will extend the pair’s gains towards 1.1970, and the gains may extend later to visit the psychological barrier of 1.2000.

Only from below is the return of trading stability below 1.1820, and the most important 1.1800 will immediately stop the bullish trend, and we will witness a re-test of 1.1720, a correction of 23.60%, before continuing the rise again.

| S1: 1.1860 | R1: 1.1935 |

| S2: 1.1815 | R2: 1.1960 |

| S3: 1.1770 | R3: 1.2005 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations