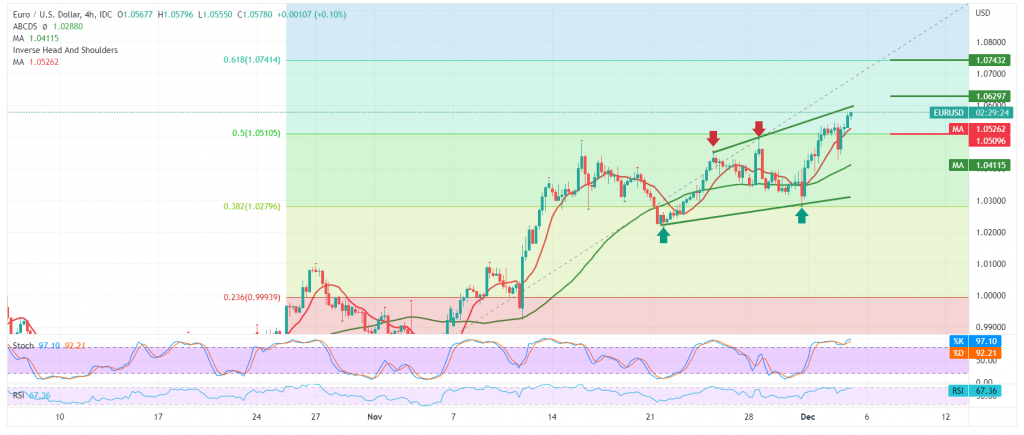

The euro-dollar pair jumped to the top, achieving strong gains. However, as a reminder, we indicated during the last technical report that the resumption of the rise depends mainly on confirming the pair’s breach of the resistance level of the psychological barrier 1.0400, to target 1.0520, recording its highest level during the morning trading of the current session at 1.0578.

Technically, we find that the EUR/USD pair succeeded in confirming the breach of the resistance level of 1.0520, represented by Fibonacci correction 50.0%, as shown on the chart, and we find that the pair is stable above the simple moving average, which supports the bullish price curve.

With steady daily trading above 1.0475, the bullish scenario remains, targeting 1.0630 as a first target. Then 1.0680 as the next official station, considering that the consolidation of the Euro-dollar pair above 1.0680 increases and accelerates the strength of the bullish trend, to be waiting for 1.0740, the 61.80% correction stations official for the current rally.

Consolidation above 1.0475, and in general, above 1.0400 are essential conditions for maintaining the bullish trend.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0475 | R1: 1.0630 |

| S2: 1.0380 | R2: 1.0680 |

| S3: 1.0320 | R3: 1.0775 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations