In the dynamic world of forex trading, the Euro/Dollar pair maintains its upward trajectory, demonstrating quiet yet positive trading sessions. During yesterday’s session, the pair reached its pinnacle at 1.0832, showcasing a bullish stance.

Technical Analysis Insights

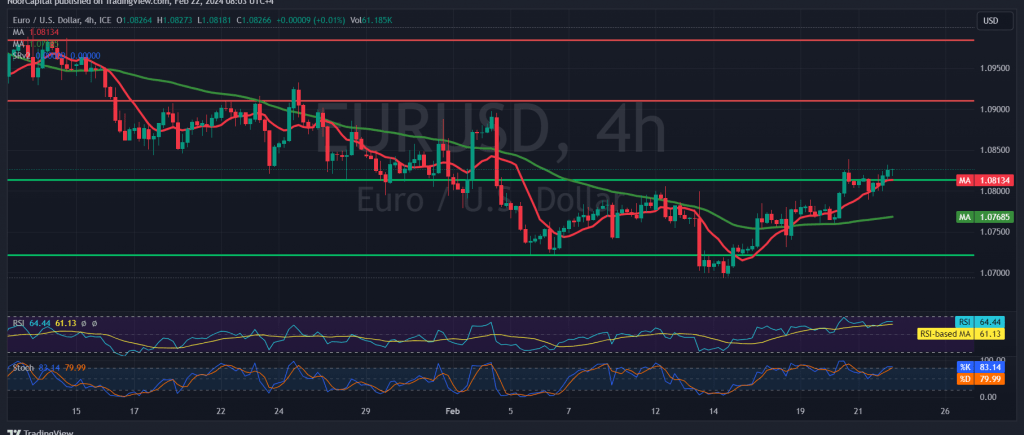

Delving into the technical analysis realm today, a closer examination of the 4-hour timeframe chart reveals significant indicators. The 50-day simple moving average acts as a robust support, bolstering the upward momentum of prices. Moreover, a notable breakthrough occurs as the pair successfully breaches the 1.0765 resistance level, now transformed into a sturdy support level through the phenomenon of role reversal.

Path Ahead: Positive Expectations

With the steadfast trading stance above 1.0765, confidence surges in maintaining positive projections. The initial target of 1.0860 beckons as the first official station. Furthermore, the consolidation of prices above this level amplifies the vigor of the upward trend, paving a direct path towards 1.0960.

Potential Downturn Risks

However, caution looms on the horizon. Any retreat in stability below the critical support level of 1.0765 threatens to disrupt the current upward wave. In such a scenario, a downward trend emerges, with the aim of retesting 1.0720 and 1.0680 as initial support zones.

Economic Data Alert

A note of caution resonates as high-impact economic data looms on the horizon. Today, the European economy anticipates the preliminary reading of the services and manufacturing PMI index for France and Germany. Meanwhile, the United Kingdom awaits similar data releases. Additionally, from the United States, market participants keenly await updates on unemployment benefits and the preliminary reading of the purchasing index for both the services and manufacturing sectors. Expectations of heightened volatility during the release of these news items prevail. Traders are advised to tread cautiously during these periods of market sensitivity.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations