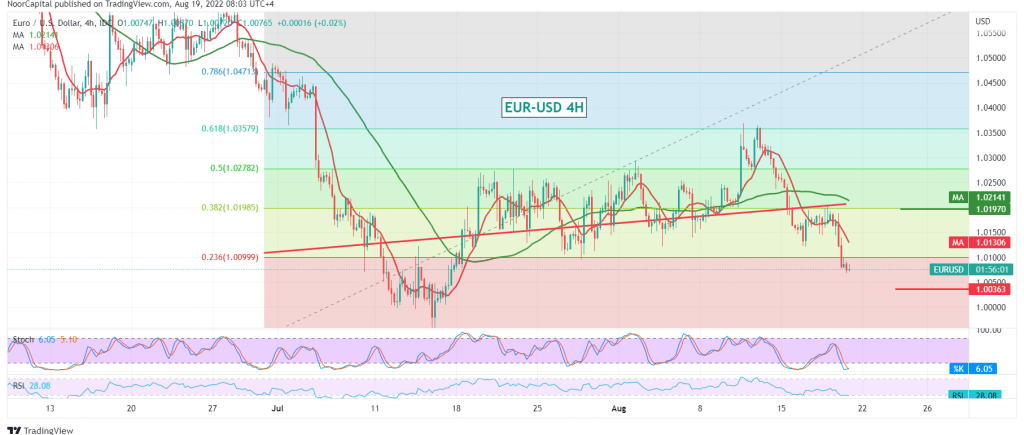

A bearish trend dominated the movements of the Euro against the US dollar, as we expected during the technical outlook yesterday, touching the official target station at 1.0100, to record the lowest level at 1.0070 during the early trading of today’s session.

Technically, the Euro failed to maintain trading above the psychological support level of 1.0100. We find the simple moving averages continuing to support the bearish curve of prices accompanied by the clear negative signs on the RSI.

Therefore, the bearish scenario will remain valid and effective, targeting 1.0040, a first target, considering that breaking the mentioned level will extend the Euro’s losses so that we are waiting to touch 0.9990, and the bearish targets may extend later to visit 0.9940.

Activating the suggested scenario requires the intraday trading to remain below 1.0160 and below 1.0200.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0040 | R1: 1.0160 |

| S2: 0.9990 | R2: 1.0240 |

| S3: 0.9920 | R3: 1.0275 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations