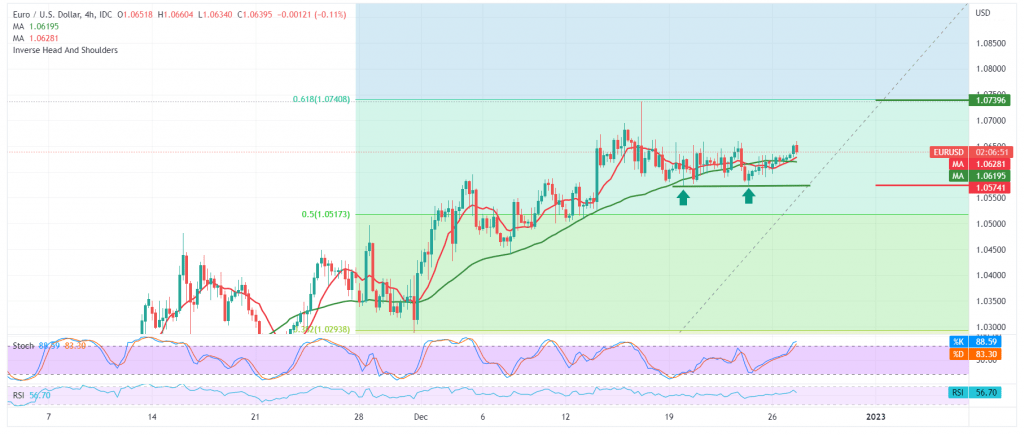

The Eurodollar pair opened its weekly trading on an upward slope, as we expected, heading to visit the first target to be achieved during the last report at 1.0660, recording its highest level during the Asian session for today’s session at 1.0660.

On the technical side today, and by looking closely at the 4-hour chart, we find that the EUR/USD pair achieved an intraday consolidation above 1.0600, and in general it succeeded in establishing a good support floor at 1.0570, accompanied by the continuation of the pair getting a positive impulse from the simple moving averages.

Therefore, the chances of a rise may be present and effective, considering that consolidation above 1.0660 is a prerequisite for facilitating the task of visiting 1.0700 and 1.0740, Fibonacci 61.80%, as the next official stop.

The decline below 1.0570 will immediately stop the suggested bullish scenario and lead the pair to retest 1.0510, the 50.0% correction.

Note: In light of the absence of economic indicators during the holiday season, and thin trading volumes, it may cause irregular movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0600 | R1: 1.0660 |

| S2: 1.0570 | R2: 1.0700 |

| S3: 1.0510 | R3: 1.0740 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations